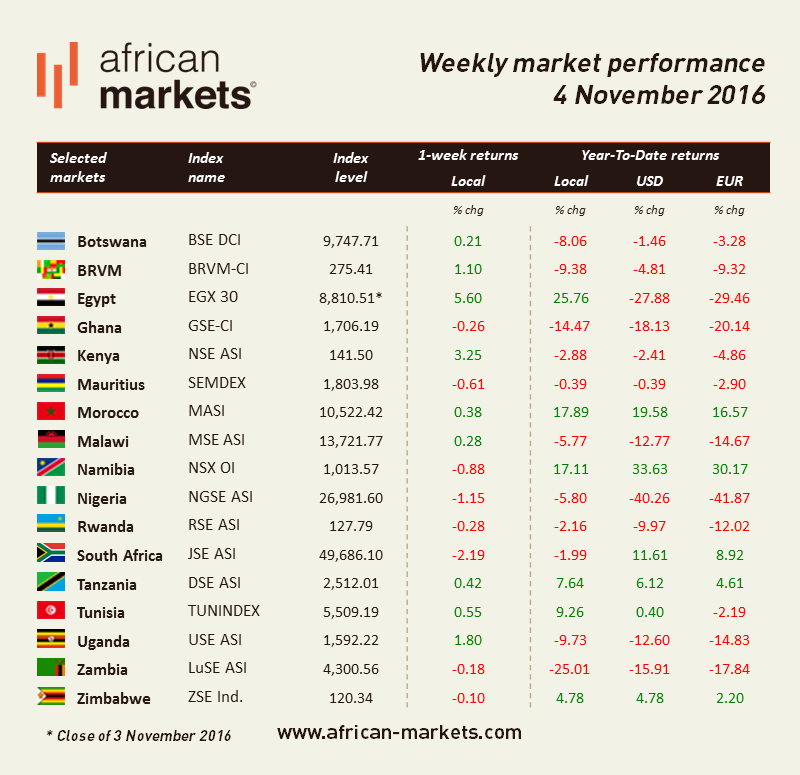

The EGX30 is the top performer of the week, gaining 5.60%. Excitement gain the Egyptian market this week as the Central Bank of Egypt finally decided to allow the Egyptian pound to float and increase interest rates by three percentage points. The devaluation of the pound will put the currency on par to its value on the black market. The benchmark strengthened as a result as the move brought the country closer to securing a $12bn loan by the IMF. Dollar shortage means that investors will still face capital controls preventing them to repatriate profits.

According to the World Bank, Kenya’s economy is expected to expand by 5.9% this year which compares to an average of 1.7% for Sub-Saharan Africa. Growth will be driven by increase productivity in the agricultural sector and tourism and foreign direct investments. The World Bank forecasts a growth of 6% for 2017 and 6.1% in 2018. The NSE ASI gained 3.25%.

The NGSE ASI lost 1.15%. The African Bank of Development approved a $600 mn loan to support Nigeria's economy while the country is battling a recession for the first time in 20 years. The loan is intended to help fill the budget deficit. It is the first tranche of a $1 bn loan and the remainder is conditional to the achievement of milestones linked to the implementation of economic reforms.

The DSE ASI gained 0.42%. Morocco and Tanzania signed 21 Memorandums of Understanding for economic development in sectors such as energy, mining, gas, aviation, agriculture and tourism during the visit of King Mohammed VI of Morocco in the country. The signed MoUs demonstrate the aim of Morocco to establish relations of mutual benefit with African countries.

Political tension heightened in South Africa as the High Court ordered the publication of a report that could expose President Zuma’s relationship with the Gupta family. The report is intended to show the alleged influence of this family over cabinet appointments and contracts with state companies. Moreover, S&P warned SA that the lack of much needed economic reforms due to political tensions could make it difficult for the rating agency to believe the government is in a position to make the necessary changes needed to turn the economy around. JSE ASI is the worst performer of the week, it lost 2.19%.