As the summer break makes its entry, African markets remain as volatile as we know them. The losers of last week outperformed and became the winners of this week.

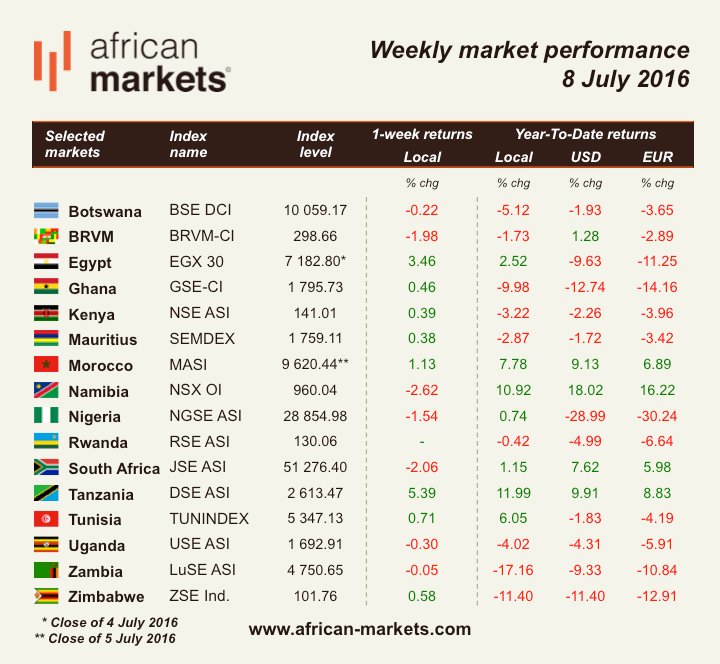

EGX30, closed for the last three days of last week, rose 3.46% on the back of gains in global markets, making use of the absorption of Brexit shock and after buying appetite came back following the CBE governor’s statement that factories’ operation is more important than stabilizing the exchange rate indicating a possible devaluation of the Egyptian pound.

JSE ASI fell 2.01%. IMF cut South Africa’s 2016 growth outlook to 0.1% this week which would mean a second year of falling per capita incomes. Although the fund recognises the positive dialogue with the government, labour and business, it still highlighted the need for reforms suggesting the implementation of measures especially focusing on the private sector. Such weak prospect could support the major international credit rating agencies’ decision to downgrade South Africa’s rating to junk status when the ratings are reviewed later this year. The search for yield boosted the South African currency against the dollar on Friday despite stronger than expected US payroll data. The latter did not seem to change investors’ mind about a potential hike of US rates this year and, in a globally low interest environment, had investors seeking yield as a result. The winners of the game seem to be the beneficiaries of the rally in gold. On Friday, Bullion producer Gold Fields was up 3.17% after Goldman Sachs upgraded it to "Buy" from "Neutral" on the back of stronger gold price.

NGSE ASI decreased by 1.54%. Skye Bank shares fell 9.7 percent on Monday. Nigeria’s central bank replaced Skye Bank’s executives after it failed to meet capital requirements. Fears over Skye's capital problems propagated to other banks, leading the bank index to decrease by 1.56% on Friday. The fall was mainly led by two banks: Diamond Bank, which shed 9.7%, and FCMB Group, which lost 8.9%.