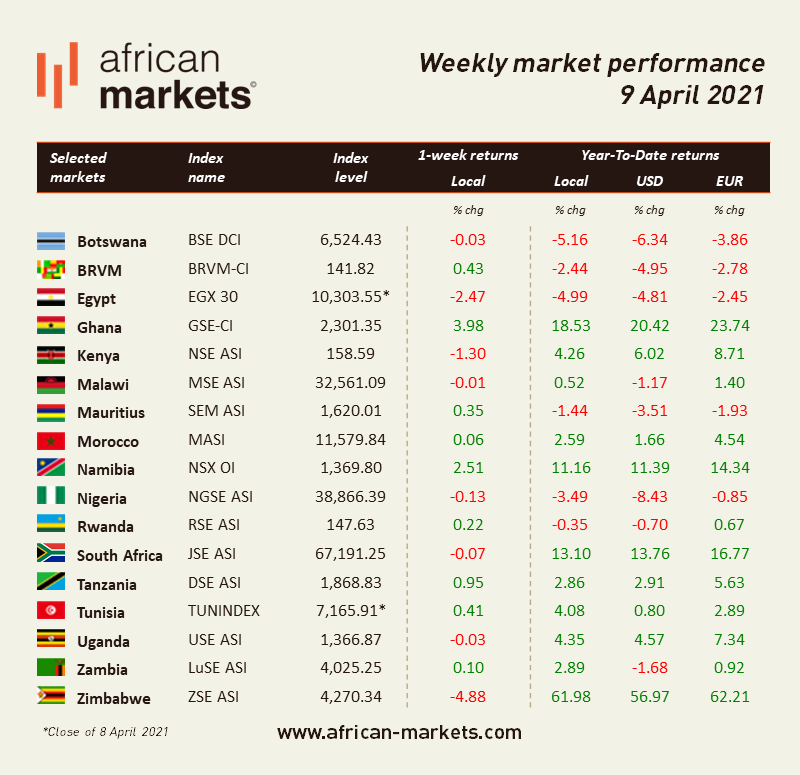

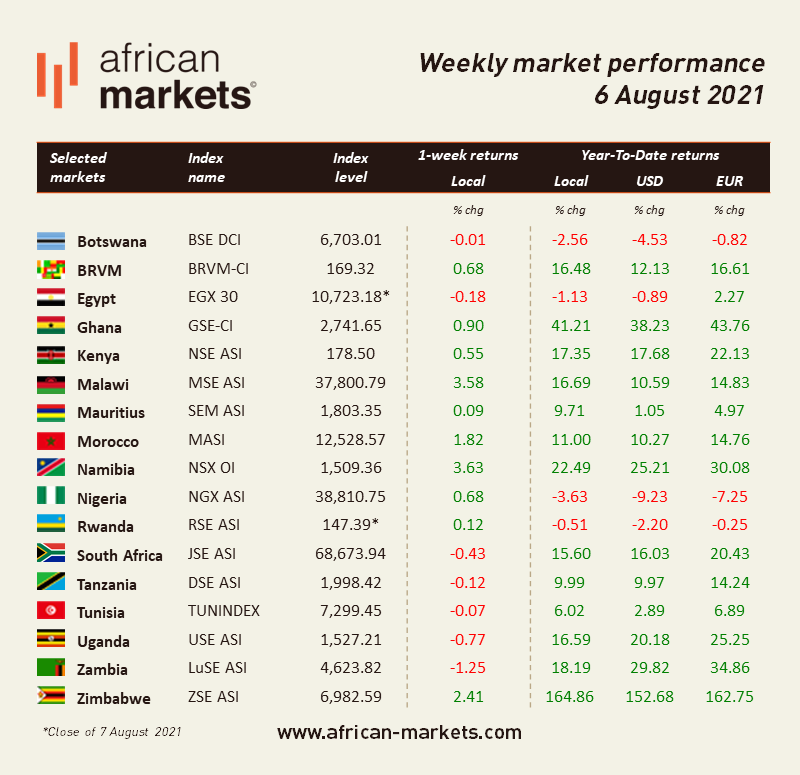

Overall sentiment on African equity markets was mixed. Among the markets we cover, 9 of them advanced during this short week while 8 retreated. Ghana led the pack as equities in Accra gained 3.98%. Conversely, Zimbabwe was the laggard. Equities in Harare lost 4.88% over the four days.

West Africa

BRVM - Equities on the Western Africa regional exchange advanced for another week. Overall, the Composite Index gained 0.43% to close at 141.82. Market activity dropped further by 35% as XOF 203m (USD 0.37m) worth of shares changed hands every day on average. The market is now down 2.44% year-to-date and the total market capitalization stands at XOF 4,268bn (USD 7.7bn). Palmci SA is the top performer this week as shares in the palm oil producer jumped 6.67%. The counter is up 42.22% since the start of the year. The market heavyweight, Sonatel, closed the week at XOF 12,995, up 1.52% over the week. Shares in the telecom operator are now down 3.74% year-to-date.

NGSE - Bears set the tone in Lagos this week. The benchmark index of the Nigerian stock exchange shed 0.13% WoW closing on Friday at 38,866.39. Stocks are now down 3.49% YTD. Activity dropped this week as NGN 2.3bn (USD 6.0m) worth of shares were traded on average over the last four days. The total market capitalization stands at NGN 20.3tn (USD 53.4bn). Flour Mills of Nigeria was among the top performers this week. Shares in the flour miller gained 6.90% and are now up 19.23% YTD. Dangote Cement, on the other hand, remained flat at NGN 215. The shares in the cement producer are down 12.21% YTD.

North Africa

BVC - Morrocan equities advanced for another week albeit slightly. The MASI gained a mere 0.06% in a week that saw MAD 79m (USD 8.9m) worth of shares change hands every day on average. The total market capitalization stands at MAD 599bn (USD 66.9bn), up 2.59% YTD. Sothema is once again one of the top performers of the week. The shares in the pharmaceuticals company soared another 10.33%. The counter is now up 83.15% YTD. The heavyweight, Maroc Telecom, closed at MAD 138.75 on Friday. The stock is down 4.31% YTD.

EGX - Bearish sentiment prevailed in Cairo as Egyptian equities declined for another week. The EGX 30 dropped 2.47% and closed at 10,303.55 points on Thursday. Compared to the previous week, average daily turnover lost 15% to EGP 0.85bn (USD 54.1m) and the total market capitalization amounts to EGP 642.4bn (USD 40.9bn). The benchmark index is now down 4.99% YTD. Raya Holding Company for Financial Investments is a notable performer this week. The stocks of the $427m market cap investment conglomerate soared 14.23% over the week but remain down 57.30% YTD. The Egyptian heavyweight, CIB, closed at EGP 55.08 on Thursday, down 6.94% YTD. Note that Fawry, the listed fintech company, closed higher on Thursday at EGP 33.95, up 2.14% from last week. The counter is now back in positive territory YTD (+1.28%).

East Africa

NSE - Kenyan equities declined for another week as the Nairobi Securities Exchange’s benchmark index shed 1.30% WoW. The average daily turnover dropped by a third to KES 515m (USD 4.8m) and the total market capitalization amounts to KES 2,436bn (USD 22.7bn). The market is now up 4.26% YTD. BK Group is the top performer this week. The shares in the Rwandan bank jumped 18.52% WoW as it announced an after-tax profit of RWF 38.4bn, a 3% increase. The counter is now up 17.07% YTD. Safaricom advanced this week as shares in the telecom operator closed at KES 36.30 on Thursday, down 2.02% WoW. The counter is up 5.99% so far this year.

Southern Africa

JSE - South African equities cooled down this week. The JSE ASI closed at 67,191.25, down 0.07% WoW. South African equities are now up 13.10% YTD. The JSE heavyweight, Prosus, closed at ZAR 1,641.67 on Friday (-5.08% WoW). Stocks in the tech investor fell sharply after the company announced on Wednesday plans to sell down its stake in Chinese internet giant Tencent. The transaction could represent up to 2% of the Chinese company’s issued share capital, representing $16bn in cash. Prosus is now up 2.21% YTD.

ZSE - Bears were back in Harare. The ASI dropped by 4.88%. Daily average turnover significantly rose to around ZWL 145m (USD 1.72m) from ZWL 80.6m the week before. The total market capitalization amounts to ZWL 498.9bn (USD 5.91bn), up 61.98% so far this year.