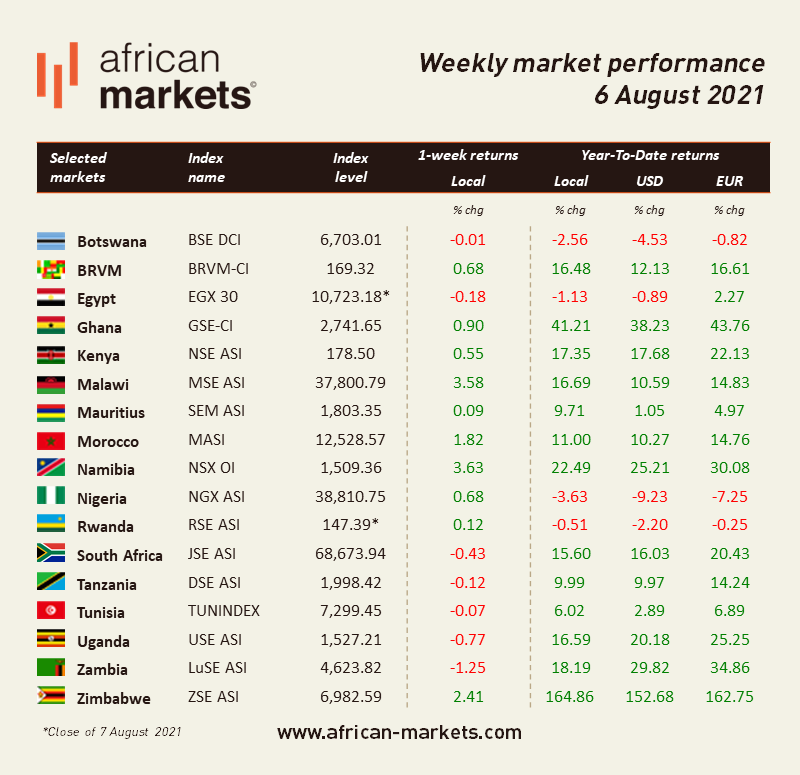

The sentiment was mixed on African equity markets this week. Among the 17 markets we cover, ten advanced while seven retreated. The Namibian Exchange led the performance charts for the second week in a row as equities in Windhoek jumped another 3.63%. Conversely, the Lusaka Stock Exchange was the laggard. Zambian equities shed 1.25% this week, the most on the continent.

West Africa

BRVM - Equities in Abidjan advanced for the fifth week in a row. Overall, the Composite Index edged up another 0.68% WoW to close at 169.32. Market activity declined 18% as XOF 280m (USD 0.50m) worth of shares changed hands every day on average compared to XOF 343m the week before. The market is now up 16.48% year-to-date, and the total market capitalisation amounts to XOF 5,096bn (USD 9.17bn). Servair Abidjan is among the top performers this week. Shares in the catering and service company jumped 16.28% and are up 20.97% YTD. The market heavyweight, Sonatel, closed at XOF 14,285 on Friday (+0.04% WoW). It is now up 5.81% since the start of the year.

NGX - Equities rallied in Lagos this week. The NGX ASI, the benchmark index of the Nigerian exchange, advanced 0.68% WoW, closing on Friday at 38,810.75. Stocks are now down 3.63% YTD. Activity dropped 31% as NGN 1.6bn (USD 3.98m) worth of shares were traded on average over the week. The total market capitalisation stands at NGN 20.2tn (USD 49.1bn). Transcorp Hotels is among the top performers. Shares in the hospitality subsidiary of the diversified conglomerate, Transcorp, gained 9.8% as the company posted solid results for the half-year ended June 30, 2021. Revenue rose by 84% to NGN 8.4bn from NGN 4.5bn in June 2020, and loss before tax improved to NGN 102m, compared to NGN 3.5bn the year before. The counter is up 8.89% YTD. The market heavyweight, Dangote Cement, remained flat at NGN 248.1 on Friday.

North Africa

BVC - Bullish sentiment prevailed in Casablanca this week. The MASI gained 1.82% over the period. Market activity increased by 7% as MAD 98m (USD 11.0m) worth of shares changed hands every day on average compared to MAD 92m the week before. The total market capitalisation stands at MAD 644.7bn (USD 72.03bn), up 11% YTD. Sothema is once again the top performer this week. Shares in the pharmaceutical company rose 16.89% and are now up 204.48% YTD. The heavyweight, Maroc Telecom, closed at MAD 138 on Friday. The stock is down 4.83% YTD.

EGX - Egyptian equities closed down this week. The EGX 30 shed 0.18% and closed at 10,723.18 points on Thursday. Compared to the previous week, the average daily turnover remained flat at around EGP 1.9bn (USD 120.6m), and the total market capitalisation amounts to EGP 706.4bn (USD 45.0bn). The benchmark index is now down 1.13% YTD. Acrow Misr is among the heavy performers this week. The company designs, manufactures, supplies and intalls metal scaffolding and frameworks used on construction sites. Shares jumped 44.51% over the period and are now up 84.06% YTD. The Egyptian heavyweight, CIB, closed at EGP 57.1 (+1.23% WoW) on Thursday and is now down 2.35% since the start of the year. Fawry, the listed fintech company, closed the week at EGP 18.00 (down 6.15% WoW).

East Africa

NSE - Equities rallied in Nairobi. The NSE ASI gained 0.55% WoW to close at 178.50. The average daily turnover declined 12% to KES 298m (USD 2.74m), and the total market capitalisation amounts to KES 2,781.64bn (USD 25.57bn). The market is up 17.35% YTD. BK Group is the second-best performer this week. The shares in the financial institution soared 11.72% WoW. The counter is now up 58.05% YTD. Safaricom closed at 42.10 KES (up 0.36% WoW). Shares are up 22.92% so far this year.

Southern Africa

JSE - South African equities cooled down as the JSE ASI closed at 68,673.94, down 0.43% WoW. KAP Industrial Holdings is among the top performers this week. Shares in the diversified industrial and logistics group jumped 48.73% and are now up 48.73% YTD. The JSE heavyweight, Prosus, closed at ZAR 1,236.89 on Friday (-5.00% WoW). Shares in the tech investor are now down 22.99% YTD.

ZSE - Bullish sentiment prevailed in Harare this week as the ASI advanced another 2.41% WoW. Daily average turnover jumped 44.6% to around ZWL 205m (USD 2.39m) compared to ZWL 142m the week before. The total market capitalisation amounts to ZWL 824.8bn (USD 9.62bn), up 164.86% so far this year.