The resignation of Tunisia’s Prime Minister, Elyes Fakhfakh, on 15 July raises the risk of a renewed political deadlock that will further delay reforms and impede efforts to agree a new programme with the IMF, says Fitch Ratings. Although Tunisia faces limited immediate financing pressures, its funding position will become much more challenging in 2021 without the support that an IMF deal would provide.

The prime minister’s resignation reflects challenges to government stability stemming from a volatile political environment, in the context of Tunisia’s democratic transition. The parliament that was elected in October 2019 is highly fragmented, making it complicated to form a coherent governing majority – after the election it took until February for the parliament to approve a new government. Strains between influential participants have risen in recent months, notably between Ennahda, the largest party in parliament, and its erstwhile coalition partners.

Forming a new government against this backdrop will be difficult and would require a coalition of at least four parties across the political spectrum. Any future cabinet’s support base in parliament will be heterogeneous and fragmented, constraining its ability to implement legislation, and the risk of snap elections will linger.

The political deadlock will delay the approval of reforms and raises significant risks around our assumption of an agreement on a new IMF programme before the end of 2020. An arrangement with the Fund is required to unlock some official creditor support, including a EUR600 million (2% of GDP) loan from the EU. Implementation of reforms under any new IMF programme will be challenging in the face of continued social and labour union opposition, as well as popular unrest aggravated by the economic fallout from the coronavirus pandemic. We forecast a 6% GDP contraction in 2020 – the sharpest on record.

We still expect the government to be able to cover its funding needs in 2020 with support from official creditors, even without a new IMF programme. (This support does, however, include a USD745 million emergency loan from the IMF, approved in April.) Tunisia will face a fiscal funding gap of around TND4 billion (USD1.3 billion, or 3.6% of GDP) in 2020, according to our estimates, reflecting our revised forecast of a central government deficit of 7.6% of GDP in 2020, up from 3.9% in 2019. Robust official creditor support for Tunisia has played an important role in balancing the external vulnerabilities stemming from the country’s large funding needs.

Tunisia’s funding position will become significantly more challenging after 2020, particularly in the absence of a new IMF programme. The country faces USD2.2 billion in external debt maturities in 2021, including two USAID-guaranteed bonds, valued at USD500 million each. In a sign of the increasing liquidity pressures, the outgoing government has indicated that it had started talks with several bilateral creditors to reschedule loan repayments due this year. Tunisia has USD500 million in repayments on bilateral debt due in 2020 and is not eligible for relief under the G20’s Debt Service Suspension Initiative.

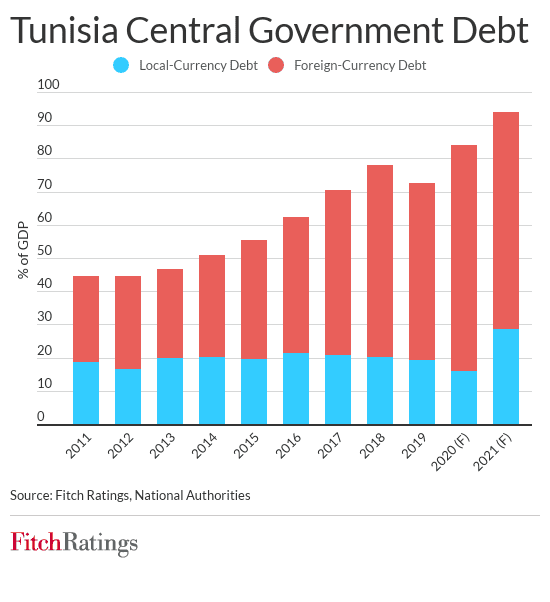

The sovereign’s exposure to external funding stress is amplified by the fact that around 73% of government debt was denominated in foreign currency as of end-2019. Downward pressures on the dinar are likely to re-emerge given Tunisia’s wide current account deficit, in our view, although the country’s foreign-currency reserves of around USD7.6 billion, as of end-June, should provide some support to the exchange rate in the near term. We highlighted the risk of deterioration in external liquidity conditions as a negative sensitivity for the sovereign rating when we downgraded Tunisia’s rating in May to ‘B’ with a Stable Outlook, from ‘B+’ with a Negative Outlook.