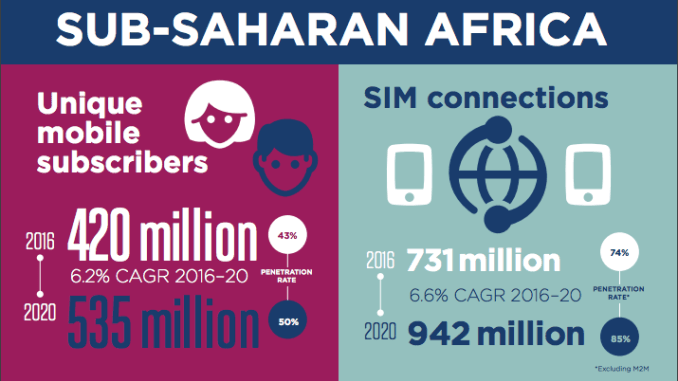

According to a recent report by GSMA, there were 420 million unique mobile subscribers in Sub-Saharan Africa as at the end of 2016, equivalent to a penetration rate of 43%. The region continues to grow faster than any other region; the compound annual growth rate (CAGR) of 6.1% over the five years to 2020 is around 50% higher than the global average.

The report estimates that the region will have more than half a billion unique mobile subscribers by 2020, by which time around half the population will subscribe to a mobile service. The total number of SIM connections in the region reached 731 million at the end of 2016, and will rise to nearly 1 billion by 2020.

Less than a fifth of under-16 year-olds (who account for more than 40% of the population in most countries in the region) have a mobile subscription, while women were 17% less likely than men to own a mobile phone in 2016.

The uptake of mobile services by these underserved groups will, in large part, drive subscriber growth in the future. Four of the most populated markets in the region – DRC, Ethiopia, Nigeria and Tanzania – will account for nearly half the 115 million new subscribers expected by 2020.

Mobile broadband and smartphone adoption gain momentum

The number of mobile broadband connections will reach half a billion by 2020, more than double the number at the end of 2016, and will account for nearly two thirds of total connections in the region. 3G will remain the dominant mobile broadband technology for the foreseeable future, but 4G adoption is rising rapidly following increasing network rollout. As of March 2017, there were 97 live 4G networks in 39 countries across Sub-Saharan Africa.

Smartphone connections in Sub-Saharan Africa have doubled over the past two years to nearly 200 million, accounting for a quarter of mobile connections in 2016. Key factors supporting the growth of smartphone adoption in the region include the increasing affordability of new devices and a growing market for second-hand devices. This trend, along with the uptake of mobile broadband services, is driving demand for digital content and, consequently, an increase in mobile data traffic. Traffic is forecast to grow twelvefold across Africa as a whole over the next five years.

Around 270 million people in the region access the internet through mobile devices, while the number of registered mobile money accounts reached 280 million as of March 2017.

Tech Hubs in Africa

The report further noted that there are more than 314 active tech hubs in 93 cities in 42 countries in Africa as of March 2017. South Africa has the highest number at 54, followed by Egypt at 28 while Kenya follows closely with 27 hubs.