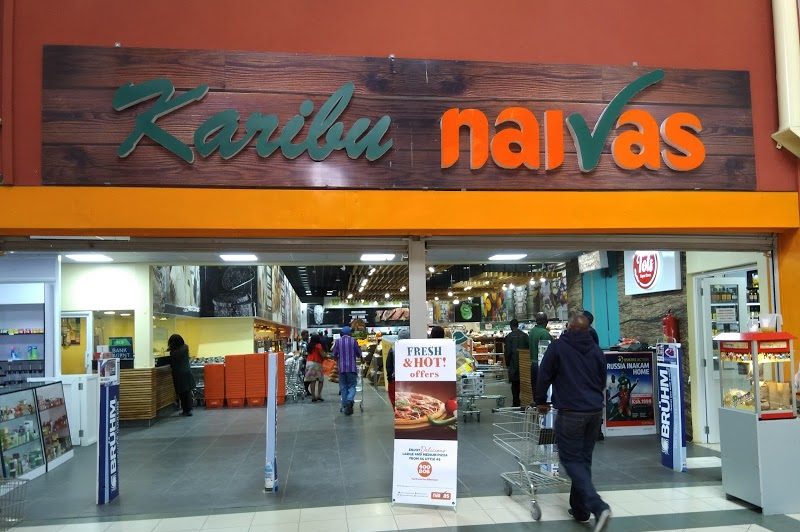

A French private equity fund, Amethis Finance, is set to acquire about a 30 percent stake in local retail chain Naivas Limited in a deal estimated to be worth billions of shilling. The transaction is set to further boost Kenya’s investment profile.

Sources familiar with the transaction told the Business Daily that talks to conclude the transaction are at an advanced stage with the parties now awaiting regulatory approval before making a formal announcement.

The investment follows the fund manager’s 2017 announcement when it sought Sh36 billion for investment in 11 countries including Kenya through Amethis Fund II investment vehicle. Amethis announced the final close of the Pan-African fund in July last year after raising Sh42 billion, which was Sh6 billion above the set target.

It was not immediately clear how much Amethis is set to inject into Naivas but historical data shows that the fund typically invests between Sh1.1 billion and Sh4.4 billion (Euro 10 million to 40 million) or more in target firms.

"Amethis Fund II follows the same investment strategy as Amethis Fund I by providing growth capital to African mid-cap champions, through investments with an average ticket size of EUR 10-40m, or more through co-investment," said Amethis after the close of the fund.