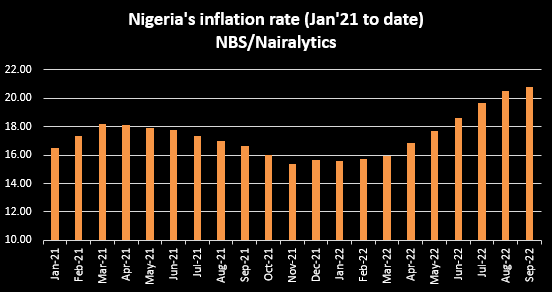

Nigeria’s inflation rate surged to 20.77% in September 2022, up from 20.52% recorded in the previous month.

The new Consumer Price Index (CPI) report by the National Bureau of Statistics (NBS) showed that Nigeria’s CPI rose by 20.77% year-on-year in September 2022. On a month-on-month basis, the index rose by 1.36% compared to the 1.77% increase recorded in the previous month.

This represents the highest rate since September 2005, according to data tracked by Nairalytics, a web portal that publishes Nigeria’s historical macroeconomic data.

Meanwhile, the urban inflation rate stood at 21.25% in September 2022 from 17.19% recorded in the corresponding period of 2021, while rural inflation stood at 20.32%.

According to the National Bureau of Statistics, the increase in the country’s inflation rate may be attributable to the disruption in the supply of food products, the increase in import cost as a result of depreciating currency, and the general increase in the cost of production.

Breakdown of the report

- The food inflation rate in September 2022 was 23.34% on a year-on-year basis, marking an uptick from the 23.12% recorded in the previous month.

- The increase in the food index was attributed to the increases in prices of bread and cereals, food products, potatoes, yams, other tubers, oil, and fat.

- Meanwhile, on a month-on-month basis, the food inflation rate was 1.43%, marking a 0.54% decline compared to the rate recorded in August 2022 (1.98%).

- The ‘’All items less farm produce’’ or Core inflation which excludes the prices of volatile agricultural produce, stood at 17.60% in September 2022 on a year-on-year basis, up from 17.2% recorded in August 2022.

- The highest increases were recorded in prices of Gas, Liquid fuel, Passenger transport by Air, Passenger travel by road, and Solid fuel.

In September 2022, all items inflation rate on a year-on-year basis was highest in Kogi (23.82%), Rivers (23.49%), and Benue (22.78%). On the flip side, Abuja (17.87%), Borno (18.12%), and Adamawa (18.42%) recorded the slowest rise in headline Year-on-Year inflation.

In terms of food inflation, the year-on-year increase was highest in Kwara (33.09%), Kogi (28.46%), and Ebonyi (27.41%), while Kaduna (18.84%), Jigawa (19.20%) and Sokoto (19.44%) recorded the slowest rise.

CBN’s latest actions

The Monetary Policy Committee of the Central Bank of Nigeria during the last MPC meeting in September raised the benchmark interest rate by 150 basis points from 14% to 15.5%. The hike marked the highest level in 20 years and the decision was made in a bid to curb the rising cost of goods and services in the country.

Also, the CBN increased the cash reserve requirement (CRR) to a minimum of 32.5%, to mop up excess liquidity in the economy while discouraging currency speculators. However, the exchange rate has been on a downtrend so far this year, falling to as low as N740 to a dollar at the black market and N440/$1 at the official Investors and Exporters window.

The continuous depreciation of the naira against the US dollar has significantly impacted the rising rate of inflation coupled with sustained supply chain disruptions and the global energy crisis. Meanwhile, it is expected that the twin monetary approach of the CBN will begin to have an impact in the short term.