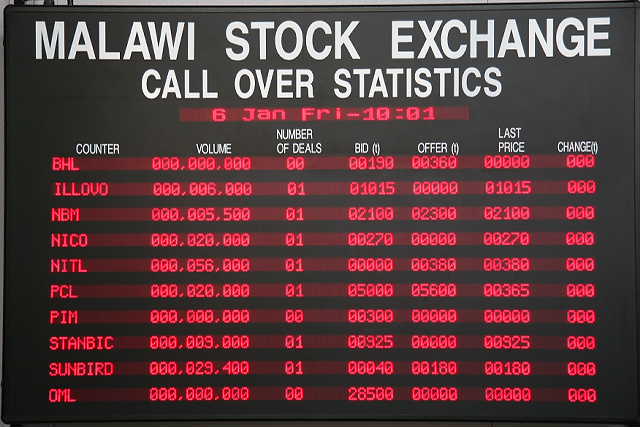

The Malawi Stock Exchange (MSE) on Thursday opened a new chapter in its history when it kick started electronic share trading.

MSE Chief Executive Officer, John Kamanga, confirmed the development during FMB Capital Holdings (MSE:FMBCH) and National Bank of Malawi (MSE:NBM) annual general meetings on Thursday and Friday, respectively.

Kamanga said the going live of online electronic trading puts the MSE at par with advanced stock markets in the world.

“I would like to tell shareholders that we have now gone live and share trading is now electronic,” said Kamanga said.

He said following commencement of the electronic trading, the market has phased out physical share trading.

The MSE boss appealed to shareholders to dematerialise their physical share certificates so that they are converted into electronic documents which are safe.

Traditionally, shareholders were given physical share certificates as proof of ownership of shares in listed entities.

Kamanga said the dematerilaisation process would help reduce incidences of fraud involving share certificates.

He added that electronic trading would help reduce the amount of time taken to conclude deals on the market.

The MSE has been in existence since 1994 but started equity trading in November 1996 when it first listed National Insurance Company Limited (Nico).

Prior to the listing of the first company, the major activities that were being undertaken were the provision of a facility for secondary market trading in Government of Malawi securities namely; Treasury Notes and Local Registered Stock.

The MSE is licensed under the Financial Services Act 2010 and operates under the Securities Act 2010 and the Companies Act 2013.

The MSE has three platforms, namely the main board, alternative capital market and debt market. The main board is meant to cater for larger and well established companies, while the alternative capital market was established to provide opportunity for the small and medium enterprises who would like to raise capital at a lower cost by accessing public funds.

The debt market caters for issuers that would want to raise debt capital as opposed to share capital.