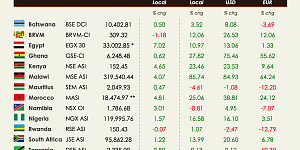

The bullish sentiment prevailed on African equity markets this week. Among the 17 markets we cover, 11 advanced while 6 retreated. The Ghanaian Stock Exchange was back at the top of the performance chart as equities in Accra rallied 7.50%. Conversely, the Egyptian market was the laggard for the second week in a row as equities in Cairo dropped another 1.83%.

West Africa

BRVM - Equities in Abidjan cooled down this week. Overall, the Composite Index shed 0.85% WoW to close at 155.39. Market activity dropped 39% as XOF 244.5m (USD 0.45m) worth of shares changed hands every day on average compared to XOF 402.0m the week before. The market is now up 6.89% year-to-date and the total market capitalization stands at XOF 4,676bn (USD 8.63bn). Sucrivoire is the top performer this week. The company’s shares soared 22.9% as it announced a 35% jump in net profit in Q1 2021. The market heavyweight, Sonatel, closed the week at XOF 13,500, down 5.59% over the week. Shares in the telecom operator are now back at the level they started the year.

NGX - Equities in Lagos rallied this week. The benchmark index of the Nigerian exchange gained 1.23% WoW closing on Friday at 38,726.10. Stocks are now down 3.84% YTD. Activity remained flat as NGN 1.9bn (USD 4.6m) worth of shares were traded on average over the week. The total market capitalization stands at NGN 20.2tn (USD 49.05bn). Coronation Insurance is the top performer this week. Shares in the insurer jumped 20.0% and are now up 47.5% since the start of this year. The market heavyweight, Dangote Cement, rose to close at NGN 220 (+3.53% WoW). The shares in the cement producer are down 10.17% YTD.

North Africa

BVC - Another week, another gain. Nothing seems to stop Morrocan equities as the market in Casablanca advanced for the 13th consecutive week. The MASI advanced another 1.75% in a week that saw MAD 153.5m (USD 17.4m) worth of shares change hands every day on average. The total market capitalization stands at MAD 638bn (USD 72.2bn), up 9.64% YTD. Sonasid is the top performer of the week. Shares in the steel producer gained 10% as the company announced a 54% increase in revenues in Q1 2021. The counter is now up 64.33% YTD. The heavyweight, Maroc Telecom, closed at MAD 140.8 on Friday. The stock is down 2.9% YTD.

EGX - Bearish sentiment prevailed in Cairo. The EGX 30 shed another 1.83% and closed at 10,054.81 points on Thursday. Compared to the previous week, the average daily turnover decreased 17.1% to EGP 1.6bn (USD 100.4m) and the total market capitalization amounts to EGP 648.6bn (USD 41.34bn). The benchmark index is now down 7.29% YTD. The Egyptian heavyweight, CIB, closed at EGP 52.27 on Thursday and is now down 11.69% since the start of the year. Note that Fawry, the listed fintech company, closed the week at EGP 21.14 (down 3.21% WoW).

East Africa

NSE - Bears were back in Nairobi this week. The NSE ASI declined 1.63% WoW to close at 169.87. The average daily turnover dropped 42% to KES 579.0m (USD 5.37m) and the total market capitalization amounts to KES 2,645bn (USD 24.51bn). The market is up 11.68% YTD. Nation Media Group is among the top performers this week. The shares in the East African media group jumped 22% WoW and are now up 46.28% YTD. Safaricom closed at 40.50 KES, down 3.23% WoW. Shares are up 18.25% so far this year.

Southern Africa

JSE - South African equities advanced for another week. The JSE ASI gained 0.40% this week to close at 67,825. The South African benchmark index is now up 14.17% YTD. Barloworld Ltd is among the top 5 performers this week. Shares in the industrial equipment group soared 19.8% this week as the company announced that the disposal of its Motor Retail business announced last December was effective from 1st June 2021. The total proceeds are estimated to be at ZAR 1bn. The JSE heavyweight, Prosus, closed at ZAR 1,427.63 on Friday (-0.3% WoW). Shares in the tech investor are now down 11.12% YTD.

ZSE - Bullish sentiment prevailed in Harare this week as the ASI advanced for another 4.26% WoW. Daily average turnover increased to around ZWL 143.3m (USD 1.69m) from ZWL 129.7m the week before. The total market capitalization amounts to ZWL 658.7bn (USD 7.77bn), up 114.17% so far this year.