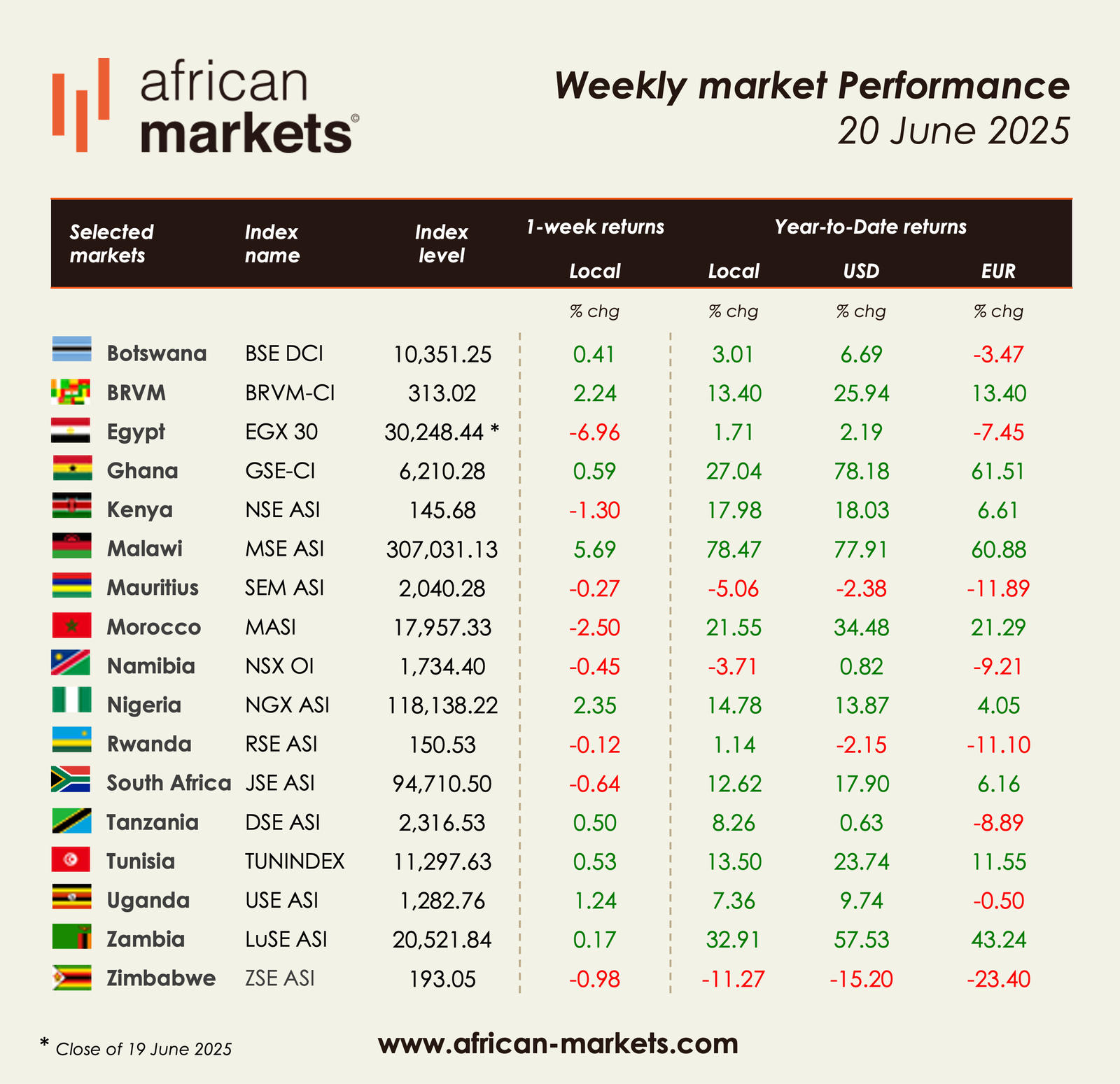

African equity markets posted a mixed performance this week, reflecting the diverse economic and investor dynamics across the continent. While some markets extended their upward momentum, others were hit by profit-taking and macro-driven volatility. This divergence continues to highlight the importance of selectivity and a localized approach to African investing.

Malawi’s stock market led the continent once again, with the MSE All Share Index rising by +5.69%. This brings its year-to-date performance to an astonishing +78.47%, driven largely by strong investor interest in the banking sector. NBS Bank surged +32.21%, while Standard Bank Malawi gained +15.64%, reinforcing Malawi’s status as one of Africa’s standout equity stories in 2025.

Nigeria’s NGX All Share Index gained +2.35%, fueled by solid performances from blue-chip financials and industrial stocks. Notable weekly gainers included Ellah Lakes (+23.09%), Beta Glass (+19.43%), GTCO (+18.81%), and Livingtrust Mortgage Bank (+18.88%). Heavyweights like MTN Nigeria and Seplat Energy also added nearly +10%, suggesting renewed investor confidence in the broader Nigerian market.

In Francophone West Africa, the BRVM Composite Index climbed +2.24%, extending its year-to-date gains to +13.40%. The rally was supported by strong moves in Uniwax (+13.21%), Servair Abidjan (+12.77%), SOLIBRA (+12.73%), and SOGB (+10.39%), indicating growing interest in consumer-facing and agri-business names across Côte d’Ivoire and the region.

On the flip side, Egypt’s EGX 30 plunged -6.96%, suffering from broad-based selling pressure. The worst performers of the week were dominated by Egyptian names, with EFG Hermes (-21.63%), Egyptian Iron & Steel (-20.38%), and Arab Engineering Industries (-19.21%) leading the declines. The correction comes amid concerns over macro stability and a weaker Egyptian pound, which continues to pressure investor sentiment.

Morocco’s MASI index dropped -2.50%, partially reversing last week’s gains. Despite being up more than +21% YTD, the index appears to be facing short-term profit-taking, particularly in real estate and industrial names. Elsewhere, Zimbabwe lost -0.98%, with sharp declines in names like Zimbabwe Newspapers (-20.95%) and Hippo Valley Estates (-14.97%), as currency challenges and inflation concerns persist.

Other regional performances were more muted. Ghana was up +0.59%, Tanzania rose +0.50%, and Uganda gained +1.24%. Meanwhile, South Africa’s JSE dipped -0.64%, tracking weakness in global equities and commodity prices.

From a year-to-date perspective, Malawi (+78.47%), Zambia (+32.91%), and Ghana (+27.04%) continue to dominate African equity returns in local currency terms. Meanwhile, Mauritius (-5.06%), Namibia (-3.71%), and Zimbabwe (-11.27%) remain in negative territory, with structural headwinds still weighing on performance.

Top 5 Weekly Gainers

| Company | Market | Perf |

|---|---|---|

| Clydestone Ghana | GSE | +60.00% |

| El Kahera El Watania Investment | EGX | +40.01% |

| Involys | BVC | +37.84% |

| NBS Bank | MSE) | +32.21% |

| Express Kenya / IB Maroc | NSE / BVC | +30.18% |

Top 5 Weekly Losers

| Company | Market | Perf |

|---|---|---|

| Africa Clean Energy | SEM | -34.62% |

| EFG Hermes | EGX | -21.63% |

| Zimbabwe Newspapers | ZSE | -20.95% |

| Egyptian Iron & Steel | EGX | -20.38% |

| Arab Engineering Industries | EGX | -19.21% |