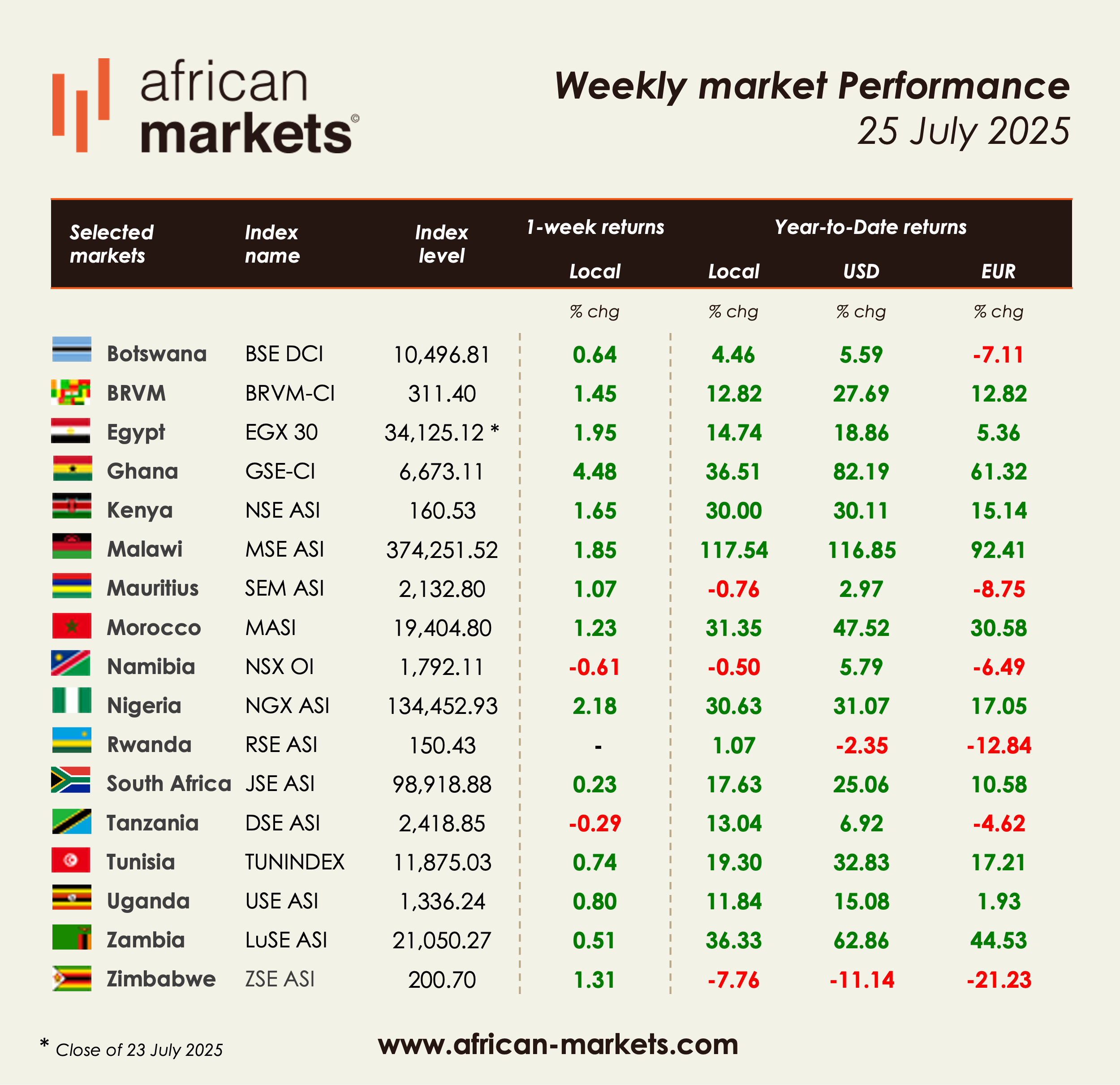

Update: An error was included in the performance of the Malawi Stock Exchange All Share Index in the previous version of this article. The mistake was due to a miscalculation by the exchange following the stock split of Standard Bank Malawi. The figures have since been corrected.

African stock markets had a dynamic week, heavily driven by IPO activity and announcements across the continent. From SKL's listing on the Nairobi Securities Exchange to the upcoming IPO of National Investment Bank in Ghana, investor interest in African capital markets is clearly gaining momentum. In Central Africa, BGFI Holding is set to launch its IPO on the BVMAC on July 31, pricing shares at 80,000 FCFA. Meanwhile, in Egypt, National Printing conducted a public offering at EGP 21.25 per share, and Bonyan's private placement was oversubscribed 6.88 times ahead of its expected EGX listing. In Rwanda, market development continues, with the first healthcare bond and the IFC’s local currency “Umuganda” bond both lined up for listing.

🔔 Don’t miss a thing! Follow us on WhatsApp with one click.

Ghana was the top performer this week, with the GSE-CI index climbing +4.48%, bringing its year-to-date gain to an impressive +36.5% in local terms. The rally was supported by continued strength in telecoms and banking, notably MTN Ghana, which gained +9.06%. Momentum was also boosted by the announcement that the long-awaited listing of National Investment Bank is now officially in motion.

Egypt gained +1.95% as investor appetite for equities remained strong, particularly in healthcare and financials. Alexandria New Medical Center surged +28.76%, and Arab Drug Company rose +25.65%. The oversubscribed private placement by Bonyan and the public offering of National Printing added fuel to the rally, keeping the EGX in the spotlight.

Nigeria continued its upward trend, with the NGX All-Share Index up +2.18%. Insurance stocks maintained their exceptional run, and small-to-mid cap companies like The Initiates Plc (+60.82%), Academy Press (+33.00%), and Wema Bank (+23.60%) led gains. Investor sentiment was buoyed by solid earnings and optimism in domestic capital formation.

Kenya advanced +1.65%, lifted by renewed investor interest and the successful listing of SKL on the Nairobi Securities Exchange. Additionally, Satrix launched its MSCI World Feeder ETF, the first equity-based ETF on the NSE, signaling the exchange’s growing product depth and sophistication.

South Africa reached a historic milestone, with the FTSE/JSE All Share Index closing above 100,000 points for the first time, 1,000 times its starting value of 100 points in January 1960. The past five years (2020–2025) have been particularly dynamic, marked by a strong post-pandemic rebound driven by surging commodity prices (gold, platinum), solid corporate earnings, and renewed investor confidence. Key sectors such as mining, banking, and technology have played a major role in this growth.

Malawi continued its impressive rally with a +1.85% weekly gain, bringing its year-to-date performance to +117.54% in local currency and +116.85% in USD. The highlight of the week was the 5-for-1 stock split by Standard Bank Malawi Plc. Namibia (-0.61%) and Tanzania (-0.29%) also posted minor losses. In Zimbabwe, the market rose +1.31%, although sentiment remained fragile following the delisting of Truworths and the pullback in several small caps.

In Rwanda, attention turned to fixed-income markets with the first-ever healthcare bond approved for listing and the IFC’s “Umuganda” bond issuance, both seen as key developments for deepening capital markets.

Top 10 Weekly Gainers

| Company | Market | Weekly Perf |

|---|---|---|

| The Initiates Plc | NGX | +60.82% |

| Unilever CI | BRVM | +43.50% |

| Hippo Valley Estates Ltd | ZSE | +36.62% |

| Academy Press Plc | NGX | +33.00% |

| Nigerian Enamelware Plc | NGX | +32.68% |

| Willdale Limited | ZSE | +31.76% |

| Meristem Growth ETF | NGX | +30.95% |

| Vicenne | BVC | +29.43% |

| Alexandria New Medical Center | EGX | +28.76% |

| Arab Drug Company | EGX | +25.65% |

Top 10 Weekly Losers

| Company | Market | Weekly Perf |

|---|---|---|

| Standard Bank Malawi Plc | MSE | -80.00% |

| Umeme Limited | USE | -27.18% |

| MOPCO | EGX | -26.68% |

| Kafr El Zayat Pesticides | EGX | -25.88% |

| Secure Electronic Tech. Plc | NGX | -23.97% |

| Omatek Ventures Plc | NGX | -23.93% |

| OK Zimbabwe Ltd | ZSE | -23.66% |

| International Agricultural Prod. | EGX | -21.59% |

| Meyer Plc | NGX | -21.43% |

| Neimeth Int’l Pharma | NGX | -19.25% |