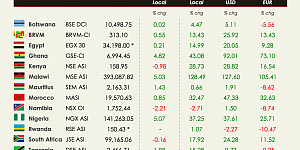

African equity markets delivered another selective week of gains, with standout rallies in Rwanda, Malawi, Tanzania, Kenya, and Zambia, while larger markets such as Nigeria, Egypt, and Zimbabwe saw consolidation. The trend underscores increasingly differentiated flows, with investors rewarding reform momentum and sector-specific catalysts.

🔔 Stay updated on African Capital Markets – follow us on WhatsApp.

Rwanda led the continent with the RSE ASI surging +13.2%, powered by KCB Group (+52.4%), while Malawi (+5.7%) extended its world-leading YTD gain past +160%, supported by strong advances in banks such as Standard Bank Malawi (+15.0%) and NICO Holdings (+15.0%). Tanzania also impressed (+4.0%) as mid-tier banks rallied, including Mkombozi (+37.0%), DCB Bank (+32.3%), and CRDB (+19.6%).

Kenya added +2.8%, benefiting from the Central Bank’s seventh consecutive rate cut to 9.50%, with retail-focused names like Eveready (+52.8%), Car & General (+29.7%), and HF Group (+26.3%) extending the momentum created by the new “one share minimum” trading rule. Zambia rose +2.8%, driven by BAT Zambia (+23.5%) and Airtel (+10.0%).

Elsewhere, Ghana (+0.4%) and Morocco (+0.1%) steadied after strong year-to-date rallies, while the BRVM (+0.9%) was lifted by Bernabé CI (+13.5%) and Vivo Energy CI (+10.2%). South Africa (+1.1%) remained supported by financials and stable domestic conditions.

On the downside, Nigeria (-0.8%) paused after three weeks of gains, pressured by steep drops in Greenwich Alpha ETF (-24.6%), UPDC (-17.7%), and Berger Paints (-14.7%), even as regulatory headlines dominated. The government raised minimum capital requirements for insurers with a one-year compliance deadline, while rival platform FMDQ confirmed plans to launch an equity market. Egypt (-0.7%) eased despite the launch of the EGX’s first mobile app, and Zimbabwe (-1.2%) extended its decline, dragged by FBC Holdings (-15.6%). Tunisia (-0.2%) traded cautiously as BNA Assurances completed its main market debut on August 14, marking one of the year’s notable financial sector listings..

In monetary policy, Uganda’s central bank held its benchmark rate at 9.75%, while Kenya’s cut reinforced liquidity support for equities. Regionally, corporate actions continued to shape sentiment, including Bosquet Investments’ acquisition of a 21.2% stake in Ecobank from Nedbank, highlighting ongoing cross-border strategic moves in African finance.