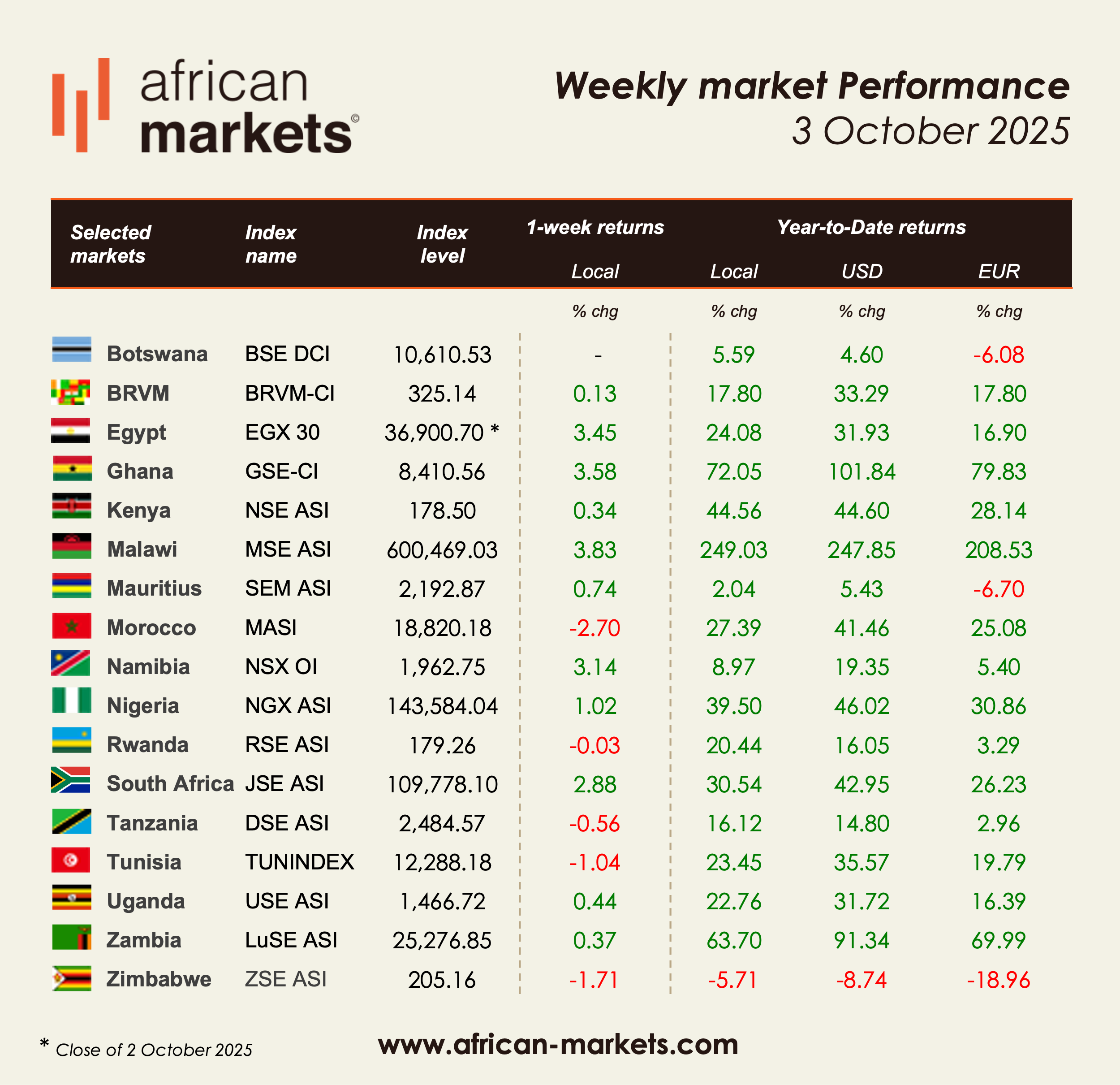

African equities advanced again this week, with most regional exchanges closing higher amid firm foreign inflows and stable macro signals. Momentum was broad-based — from strong showings in Malawi, Namibia, and South Africa to steady recoveries in Nigeria and Kenya — while Morocco and Zimbabwe saw moderate pullbacks after recent rallies. The mood across the continent remained cautiously optimistic, reflecting a phase of consolidation rather than correction.

🔔 Follow our WhatsApp Channel for real-time news updates.

Egypt extended its rebound this week, supported by the Central Bank of Egypt cut its policy rate by 100bps, while GDP growth accelerated to 5% in Q4 FY2024/25. The EGX30 gained +3.45%, extending YTD gains to +24.1% in local terms. Financials and industrials outperformed, with strong moves from Cairo Educational Services (+42.7%), Mansoura Poultry (+35.6%), and Edita Food Industries (+20.7%). On the downside, El Dawlia Fertilizers (-42.1%) and Egypt Free Shops (-11.7%) dragged.

In Ghana, sentiment improved further as headline inflation dropped below 10% for the first time since 2021, bolstering appetite for financials. The GSE-CI rose +3.58%, extending its YTD rally to +72.1% (up +101.8% in USD). Banks led the gains, including Ecobank Ghana (+20.0%), CalBank (+9.5%), and GCB Bank (+6.9%), while MTN Ghana added +3.9%.

The Malawi Stock Exchange remained world-beating, advancing +3.83% this week and an astonishing +249.0% YTD in local currency. Gains were driven by National Investment Trust (+16.0%), National Bank of Malawi (+14.8%), and FMB Capital (+8.9%), offsetting mild profit-taking in Telekom Networks Malawi (-5.3%).

In Nigeria, the NGX ASI added +1.02%, extending its year-to-date advance to +39.5% (+46.0% in USD). The tone was constructive, led by renewed activity in banking and telecom counters, with MTN Nigeria maintaining its leadership position.

South Africa’s JSE ASI climbed +2.88%, supported by gains in financials and resource-linked names. Market sentiment was boosted by Cilo Cybin, a South African medical cannabis investment company, moved from the AltX to the Johannesburg Stock Exchange’s Main Board, under its General Segment.

The BRVM Composite Index in West Africa edged up +0.13%, continuing its steady performance (+17.8% YTD local). Activity was buoyed by corporate stories and infrastructure themes. Strong performers included Filtisac (+42.8%), Bernabé CI (+24.8%), and Tractafric Motors (+16.4%). On the policy front, Ivory Coast granted 11 new mining permits for gold, cobalt, and copper, reinforcing the region’s mining momentum. The week also saw a major sustainable finance milestone: SENELEC (Senegal) issued XOF 120 billion in green and sustainability-linked bonds, further positioning the regional market as a leader in ESG issuance.

In Morocco, the MASI retreated -2.70% following several weeks of gains. The market digested the announcement of CMGP Group’s acquisition of 92.5% of Compagnie de Produits Chimiques du Maroc (MAD 1bn). Despite the headline deal, profit-taking hit several heavyweights — Balima (-21.8%), Maroc Leasing (-12.3%), and Lesieur Cristal (-9.5%) — while Auto Nejma (+33.7%) stood out on the upside.

Kenya’s NSE ASI gained +0.34%, aided by the launch of the NSE Banking Sector Index on 2 October, tracking 11 listed banks. Investor enthusiasm lifted several stocks including Williamson Tea (+31.2%), Car & General (+28.5%), and Kenya Power (+11.1%), while Unga Group (-5.6%) and Nation Media (-4.0%) declined.

Zimbabwe’s ZSE ASI slipped -1.71%, extending YTD losses to -5.7% in local terms, though sentiment was bolstered by an IMF projection of 6% GDP growth in 2025. Gainers included Willdale (+84.4%), Turnall (+32.2%), and BAT Zimbabwe (+24.7%), while Hippo Valley (-27.8%), Nampak (-27.7%), and Seed Co (-25.5%) weighed on the index. On the VFEX, African Sun (+31.8%) and Seed Co International (+13.6%) outperformed, while Axia (-22.2%) and Padenga (-10.7%) fell. OK Zimbabwe announced a US$10.5m property sale to accelerate recovery efforts.