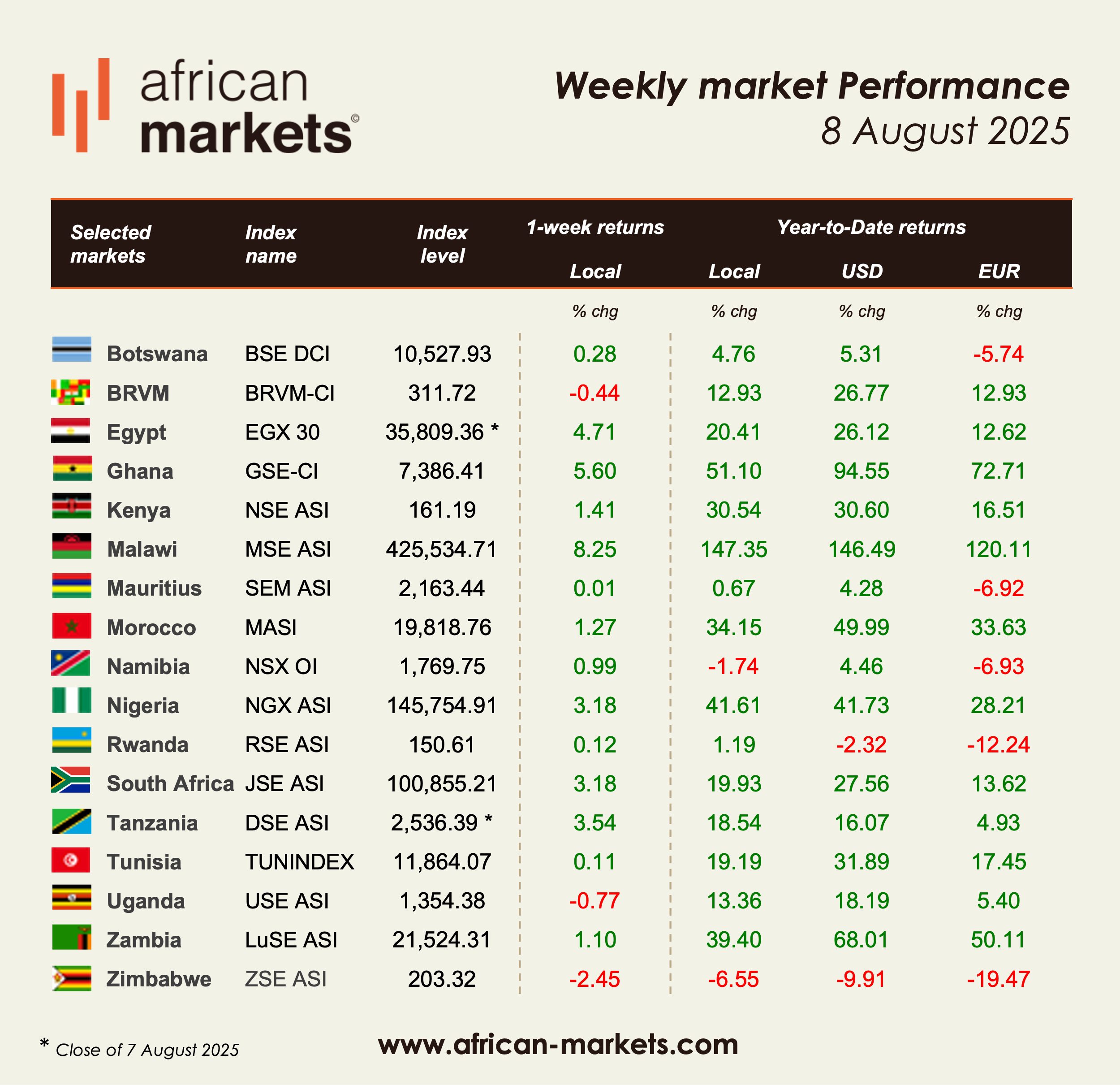

African stock markets navigated a mixed but largely positive week, with pockets of strong momentum still visible despite some signs of consolidation. The rally that took hold in July has not run out of steam, but it is becoming more selective, concentrated in high-conviction markets like Malawi, Ghana, and Nigeria, while others saw investors lock in recent gains. Sentiment was underpinned by a combination of corporate actions, upbeat economic signals, and fresh capital market developments, from new IPOs in Egypt to upcoming listings in Tunisia, including BNA Assurances’ move to the main market and the anticipated Taraji Holding IPO, as well as strategic acquisitions in West and Southern Africa. The week also brought sector-specific headlines, notably in retail and banking, that will likely shape investor positioning in the months ahead. Against this backdrop, the continent’s top year-to-date performers continued to stretch their lead, with Malawi and Ghana still in a league of their own, while Zambia, Morocco, and Kenya rounded out the YTD top five.

🔔 Stay updated on African Capital Markets – follow us on WhatsApp.

Nigeria’s NGX ASI advanced +3.18%, moderating from last week’s +5.07% but still notching a third straight week of growth, lifting YTD gains to +41.61%. The rally was dominated by insurance names — Mutual Benefits Assurance (+60.44%), Aiico Insurance (+59.82%), and Greenwich Alpha ETF (+59.78%) — while BUA Foods (+18.93%) and Dangote Cement (+9.22%) added to the upside. MTN Nigeria fell -4.17% after last week’s market-cap milestone. Corporate activity was in focus as Coronation Infrastructure Fund prepared for a listing after a record raise, and C & I Leasing announced plans to acquire 71.15% of Ghana’s Leasafric Logistics.

Ghana surged +5.60%, extending its YTD lead to +51.10% in local currency and +94.55% in USD. The GSE-CI continued to rally on the Bank of Ghana’s 300bps rate cut, while inflation fell to 12.1% in July. MTN Ghana (+10.70%) and banks outperformed.

Malawi’s MSE ASI soared +8.25%, extending its world-leading YTD gain to +147.35%. FDH Bank (+29.80%) and Standard Bank Malawi (+15.00%) were key movers, supported by news that banking sector market capitalisation surpassed K4 trillion. FDH Bank also announced the acquisition of 98.87% of Ecobank Mozambique.

Egypt rose +4.71% (YTD +20.41%), rebounding from last week’s flat close. The EGX welcomed National Printing post-IPO and expects several large listings. The regulator issued its first rules for digital platforms investing in REITs, while retail investors grew by 123,000 in H1 2025.

Kenya advanced +1.41%, lifting YTD to +30.54%. Sameer Africa (+43.59%) and Olympia Capital (+20.54%) extended rallies ahead of the August 8 rule change scrapping the 100-share minimum trading requirement. NSE now allows retail investors to buy a single share of a listed company, the main goal: to lower entry barriers and encourage broader participation, particularly from retail and first-time investors.

South Africa’s JSE ASI climbed +3.18% (YTD +19.93%), aided by stronger risk appetite and financials. Nedbank announced the sale of its 21.2% Ecobank stake, ending a 17-year partnership. In retail, Shoprite Holdings, the country’s largest retailer, said it will sell its operations in Ghana and Malawi to focus on its domestic market.

Tunisia’s TUNINDEX edged up +0.11% this week, extending its steady year-to-date gain to +19.19%. Investor attention was focused on upcoming market activity, with BNA Assurances set to move from the OTC market to list on the main market on August 14, in what will be one of the year’s notable financial sector listings. The exchange had also granted preliminary approval last month for the IPO of Taraji Holding, the commercial arm of Espérance Sportive de Tunis, with the transaction still pending final regulatory clearance.

Zimbabwe fell -2.45%, deepening its YTD decline to -6.55%. Losses were broad-based, with Masimba Holdings (-30.77%), Mashonaland Holdings (-28.32%), and Willdale (-24.86%) leading the drop. On the VFEX, Axia (+15.83%) gained while Simbisa Brands (-3.54%) eased.

BRVM dipped -0.44% (YTD +12.93%), ending a two-week winning streak. Alios Finance (+31.40%) and Vivo Energy CI (+9.66%) outperformed, while CIE (-6.52%) and SETAO (-7.56%) weighed.

Elsewhere in African equity markets, the Algiers Stock Exchange reported a 43% surge in market capitalisation in H1 2025, underscoring North Africa’s growing capital markets momentum.