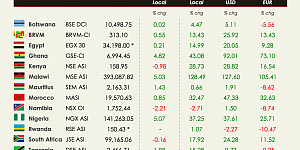

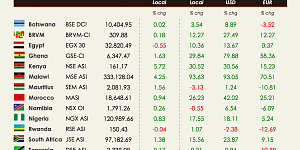

African equity markets ended the week mixed, with Malawi and Nigeria driving gains, while Kenya, Namibia, and Francophone West Africa dragged on regional performance. Meanwhile, a wave of cross-border listings, self-listings, and successful IPOs continued to energize investor sentiment across the continent.

Malawi extended its incredible rally, climbing +5.33% this week and pushing its YTD gain to +103.95%. FDH Bank (+30.96%) and Telekom Networks Malawi (+17.75%) led the charge, while confidence was boosted by continued momentum in banking and telecoms. The market remains the top performer in Africa year-to-date.

Nigeria posted strong gains, with the NGX ASI up +4.26%, supported by a broad rally in small and mid-cap stocks. Top movers included FTN Cocoa (+60.60%), Red Star Express (+60.57%), and Omatek Ventures (+60.44%). Investor interest surged following Guaranty Trust Holding’s secondary listing on the London Stock Exchange, marking a major step for West African capital markets.

Ghana gained +1.22%, aided by the IMF’s $367 million disbursement, which helped support macroeconomic stability. On the equity side, TotalEnergies Ghana (+9.92%), Access Bank Ghana (+9.63%), and Republic Bank Ghana (+9.72%) led financials higher.

Egypt rose +1.54%, rebounding from last week's pullback. While volatility persisted in small-cap pharma stocks, new listings such as Bonyan Development and Trade's IPO (21.9% stake) brought renewed attention to the EGX.

Morocco posted a steady +1.88%, ahead of the highly anticipated Vicenne listing on July 15, which IPO drew over 37,000 subscribers. Market confidence remains supported by a stable interest rate environment and solid Q2 earnings expectations.

Uganda rose +1.90%, as financials continued to recover, while Zambia (+1.48%) and Tunisia (+0.89%) also saw modest gains.

On the downside, Kenya declined -1.31%, pausing after weeks of strong rallies. Key laggards included Sameer Africa (-12.01%) and Crown Paints (-8.69%), while local investors turned cautious amid profit-taking in infrastructure and industrial stocks.

Namibia (-1.42%), BRVM (-1.27%), and Zimbabwe (-0.60%) also posted weekly losses. In Zimbabwe, EcoCash (-7.72%) and Willdale (-25.00%) weighed on market sentiment, even as the Zimbabwe Stock Exchange officially self-listed on July 11, becoming one of the few exchanges in Africa to do so.

Top 10 Weekly Gainers

| Company | Market | Weekly Perf |

|---|---|---|

| FTN Cocoa Processors Plc | NGX | +60.60% |

| Red Star Express Plc | NGX | +60.57% |

| Omatek Ventures Plc | NGX | +60.44% |

| C & I Leasing Plc | NGX | +60.33% |

| Meyer Plc | NGX | +60.07% |

| Thomas Wyatt Nigeria Plc | NGX | +59.56% |

| Ellah Lakes Plc | NGX | +55.93% |

| Nigerian Exchange Group Plc | NGX | +54.85% |

| Academy Press Plc | NGX | +49.92% |

| ABC Transport Plc | NGX | +49.15% |

Top 10 Weekly Losers

| Company | Market | Weekly Perf |

|---|---|---|

| Arab Drug Co. for Pharma & Chemical | EGX | -48.49% |

| Vetiva S&P Nigeria Sovereign Bond ETF | NGX | -37.26% |

| Hippo Valley Estates Ltd | ZSE | -27.58% |

| Willdale Limited | ZSE | -25.00% |

| starafricacorporation Ltd | ZSE | -24.53% |

| Edgars Stores Limited | VFEX | -19.55% |

| Greenwich Alpha ETF | NGX | -19.55% |

| Involys | BVC | -15.76% |

| ART Corporation Limited | ZSE | -14.91% |

| Unifreight Africa Limited | ZSE | -14.38% |