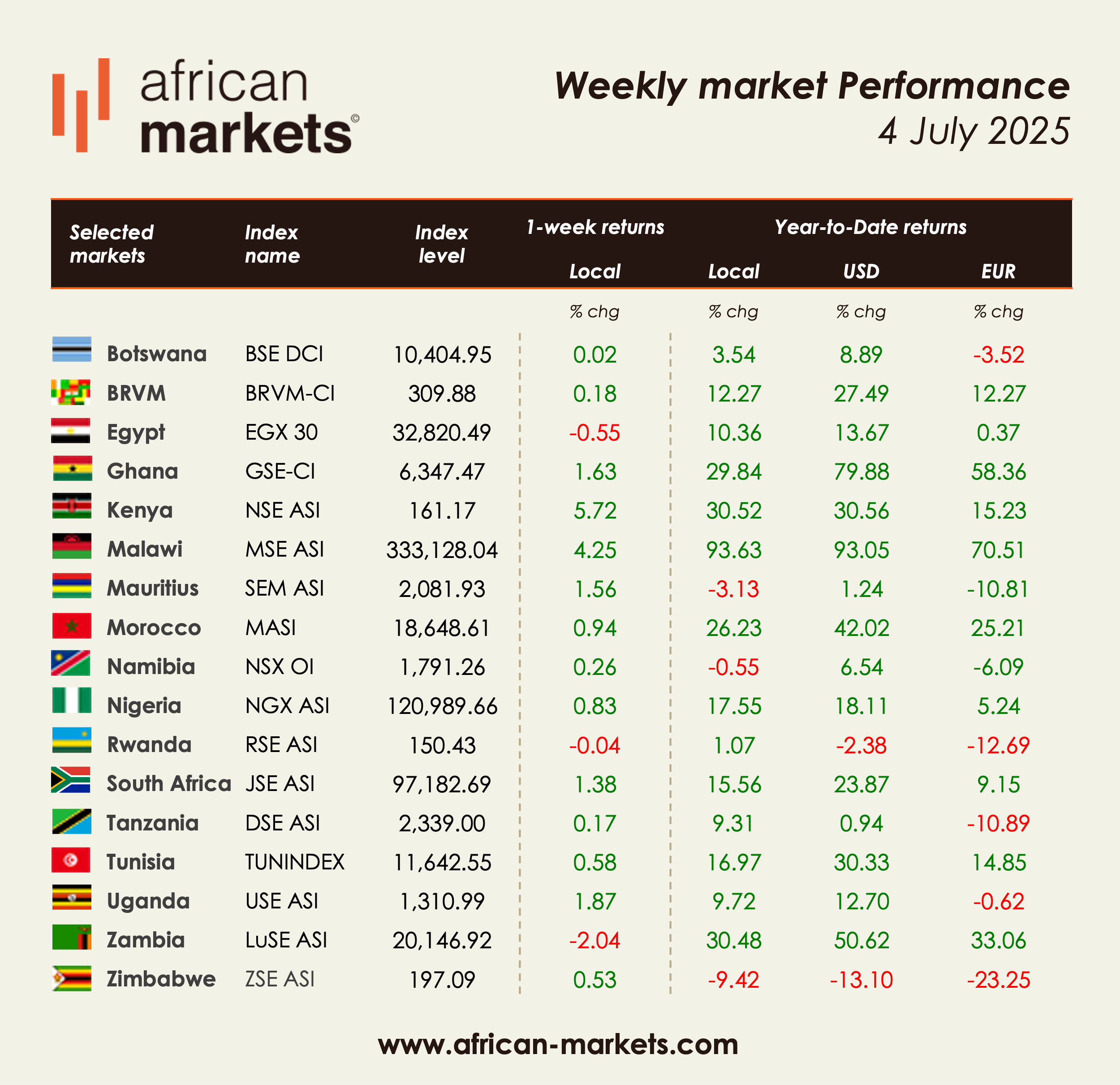

African equity markets delivered another week of gains, led by strong rallies in Kenya and Malawi, renewed investor activity in Nigeria, and upbeat sentiment in Ghana and Uganda. While Egypt cooled slightly after last week’s surge, and Morocco showed steadier momentum, corporate actions, index rebalancing, and cross-border listings continued to shape market direction across the continent.

Kenya stood out once again, with the NSE ASI surging +5.72%, accelerating from +4.65% last week. Investor enthusiasm continued to build in infrastructure and financial stocks. Sameer Africa (+48.79%) remained in the spotlight for a second week, while Kapchorua Tea (+27.15%) and Nation Media (+15.70%) also posted notable gains. The government’s announcement to privatise state-owned enterprises through IPOs at the NSE further energized market sentiment and revived interest in state-linked assets.

Malawi maintained its exceptional performance, rising +4.25% this week, adding to last week’s +4.07%. The MSE ASI is now up +93.63% YTD, driven by sustained gains in FMB Capital (+19.96%) and Telekom Networks Malawi (+10.98%). Confidence was bolstered by NBM’s K59 billion dividend payout, and sentiment remains euphoric following several weeks of strong momentum.

Ghana added +1.63%, supported by strong performance in financial stocks, as June closed on a bullish note. TotalEnergies Ghana (+10.00%) and Access Bank Ghana (+9.93%) contributed to this resilience. The announcement that Castel Group completed the acquisition of Guinness Ghana added a layer of strategic interest in consumer and beverage plays.

In Nigeria, the NGX ASI advanced +0.83%, a slight deceleration from the prior two weeks (+2.35%, +1.57%). The market remained active, with Meyer (+60.11%), R.T. Briscoe (+50.83%), and FTN Cocoa (+40.24%) among top performers. A key development was Guaranty Trust Holding’s upcoming London Stock Exchange listing on July 9, aiming to raise $100 million — a significant move for Nigerian cross-border capital markets. Meanwhile, Aradel and Wema Bank joined the NGX 30 Index following a semi-annual rebalancing, displacing Conoil and Julius Berger.

Egypt saw a modest pullback, with the EGX 30 losing -0.55%, after last week’s +7.02% surge. Speculative trades cooled off, and former high flyers like Certificates of Odin (-26.45%) and Egyptian Financial & Industrial (-9.63%) corrected sharply. Despite the retreat, Egypt maintained investor interest, especially in smaller-cap names like Gemma Ceramics (+20.46%) and Wadi Kom Ombo (+20.45%). Egypt also dominated African startup funding in May, reaffirming its position as a regional innovation hub.

Tunisia advanced +0.58%, and continues to benefit from the IPO anticipation of Taraji Holding.

Uganda gained +1.87%, despite concerns related to MTN Uganda, which announced an exit option for retail shareholders amid its Mobile Money spin-off.

Tanzania remained flat at +0.17%, though CRDB Bank (+9.38%) gained visibility after listing its Kijani Bond on the Luxembourg Stock Exchange.

Francophone West Africa’s BRVM was marginally up +0.18%, rebounding slightly after last week’s -1.18% drop. However, weakness remained in financial names like Bank of Africa - Niger (-9.43%), while SOLIBRA (+14.90%) rebounded sharply after last week’s -8.49% fall. Meanwhile, Movis CI was delisted from the BRVM following a full buyout.

Finally, the launch of the PAPSSCARD, a continental payment card aimed at enhancing trade integration across African markets, marked a significant step toward intra-African financial connectivity. Additionally, Ethiopia’s historic decision to open its banking sector to foreign investors could reshape East Africa’s financial landscape in the years ahead.

Top 10 Weekly Gainers

| Company | Market | Weekly Perf |

|---|---|---|

| starafricacorporation Ltd | ZSE | +107.11% |

| Vetiva S&P Nigeria Sovereign Bond ETF | NGX | +67.10% |

| Meyer Plc | NGX | +60.11% |

| R.T. Briscoe Plc | NGX | +50.83% |

| Grit Real Estate Income Group (USD) | SEM | +50.00% |

| Sameer Africa Plc | NSE | +48.79% |

| FTN Cocoa Processors Plc | NGX | +40.24% |

| International Energy Insurance Plc | NGX | +35.43% |

| UPDC Plc | NGX | +34.66% |

| Mutual Benefits Assurance Plc | NGX | +33.33% |

Top 10 Weekly Losers

| Company | Market | Weekly Perf |

|---|---|---|

| ENL Limited | SEM | -82.41% |

| Certificates of Odin Fund | EGX | -26.45% |

| Greenwich Alpha ETF | NGX | -18.99% |

| El Kahera El Watania Investment | EGX | -15.73% |

| Hippo Valley Estates Ltd | ZSE | -15.00% |

| PZ Cussons Nigeria Plc | NGX | -14.96% |

| Dairibord Holdings Ltd | ZSE | -14.88% |

| Zimre Holdings Ltd | ZSE | -14.28% |

| General Co. for Silos & Storage | EGX | -12.76% |

| Real Estate Investments Zambia Plc | LuSE | -11.11% |