(AFRICAN MARKETS) -- The Dar-es-salaam stock exchange has been operational for just over 2 decades now and has grown substantially beyond expectation especially in the past 3 years. The past 3 years has seen 7 new companies listed and the number of investors participating on the brouse has almost doubled. The future continues to be bright, however, this made me wonder, “where are the zanzibaris?”.

There are a very limited number of investors buying equities, and a mere fraction of them hail from Zanzibar. Now is this a cultural problem; lack of awareness or merely a substantial lack of capital; but there is a need on the isles to find ways to innovate and encourage participation of its citizens. The stock exchange is probably the most socialist thing the capitalists invented and for a socialist government, the isles have not put much effort in promoting its presence.

Of the 25 listed companies on the exchange, none of them hail from Zanzibar. Historically the island has struggled to set up a concrete manufacturing sector and today there only a handful of corporations that are even eligible. A few that come to mind are The People’s bank of Zanzibar, Zanzibar Insurance Corporation, Zanzibar Electricity Corporation, Zanzibar Sugar Factory Limited, Zanzibar Port Corporation and the various seaweed harvesting companies. Unfortunately, all these companies are either wholly owned by the revolutionary Government of Zanzibar or are private corporations that have all their financial information in lock and key.

The port business is the island's top breadwinner and can not fathom the state giving up any stake in the company. Nonetheless, two local companies that stand out and would be excellent new listings are The People’s bank of Zanzibar and the Zanzibar Insurance Corporation. The Peoples bank of Zanzibar (PBZ) was incorporated in 1966 and is not just the island’s but one of the country’s oldest banks. The bank is wholly owned by the Revolutionary Government of Zanzibar and is the only bank in the country to have its head office in Zanzibar.

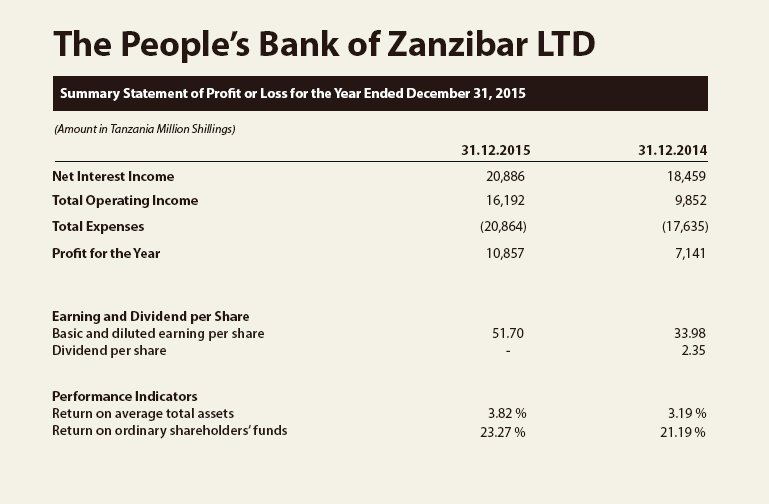

At the end of 2015 the bank had assets worth over TSh 465bn/- up from TSh 382bn/- in 2014. The bank has continually posted strong profits and at the end of 2015 recorded profits of over TSh 10bn/-. The bank's performance far exceeds the performance of various small banks already listed on the exchange. The bank currently operates 10 branches and has longed for expansion for quite some time. The IPO could be the catalyst to help raise a significant amount of capital from their citizens to accelerate their growth plan.

The other company that seems somewhat eligible to list is the Zanzibar Insurance Corporation (ZIC). ZIC, incorporated in 1969 is wholly owned by the Government of Zanzibar and is one of 31 insurance companies operating in the country. Unlike PBZ the company has had a strong presence on the mainland for many years. It is hard to gauge the size of the company, however, in 2011 the company reported a net premium for general insurance at TSh 7bn/-. This was 5 years ago and judging by the growth in the insurance industry and the economy as a whole since then, it is safe to say the company is large enough. If the company were to list, it would be the first domestic insurance company to list on the exchange.

In addition the listing of the Zanzibar Electricity Corporation (ZECO) could potentially transform the isles future. The Company pays tanesco around 100bn/- annually in electricity charges and is riddled with debt. Listing distribution companies has actually proven to be very successful in East africa; with two great examples being UMEME of Uganda and Kenya Power of Kenya. If the government can hasten wiping their debt, the company could potentially be a golden goose for the island and could get a capital boost to transform the island's power infrastructure.

The hesitation is clearly visible as the government would be losing a fraction of their revenue in the short term, however, historically, IPOs have proven to be very successful in boosting performance, growth and transparency. In the long run the move is destined to bring mainland capital into the island and increase the government's divided values. However, transparency is something the governments have never favoured and may prove difficult to convince them to give up their equity.