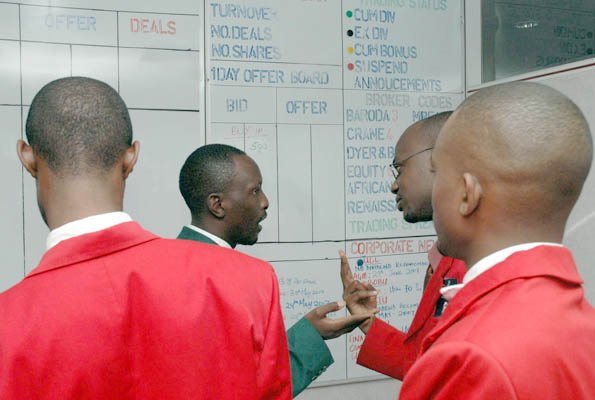

Trading at the Uganda Securities Exchange (USE) will no longer involve a large white board with traders submitting their bids and offers using marker pens.

Trading at the Uganda Securities Exchange (USE) will no longer involve a large white board with traders submitting their bids and offers using marker pens.

Yesterday, the 17 listed and cross-listed companies, for the first time in nine years, participated in automated trading, a practice that has eluded the USE since its creation.

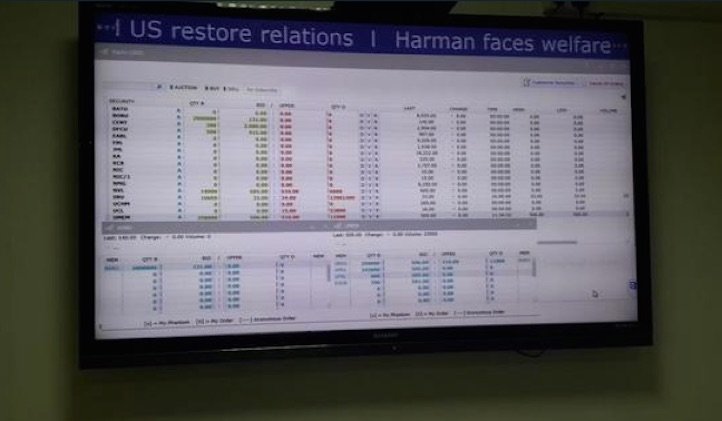

Brokers from different brokerage firms worked from their workstations. The shouting that characterized trading wasn't there, as brokers worked away at their computers, receiving orders, placing bids or buying stocks.

Paul Bwiso, the USE Chief Executive Officer said that the automation has been a long time dream aimed at elevating the stock market to international standards. Bwiso is optimistic that the automation will attract many investors, especially from other countries.

"Automation is going to bring liquidity, we are going to see more of retail investors and our foreign investors [have been] waiting for this”, he says.

Bwiso said automation has other benefits for investors like ease of doing business and ability to trade anywhere. He said with automation and increase in public awareness they hope to attract more retail investors and other companies interested in raising capital for their businesses.

He added that with depreciation of the Uganda shilling, trading on the stock market has declined from an average of Shs 900m daily down to Shs 200m daily.

Arthur Nsiko, a broker from investment banking group - African Alliance said automation is a positive step towards internationalisation of the USE, adding that it adds to a lot of flexibility in trading unlike with the manual system.

Arthur Nsiko, a broker from investment banking group - African Alliance said automation is a positive step towards internationalisation of the USE, adding that it adds to a lot of flexibility in trading unlike with the manual system.

Nsiko said automation has also enabled a longer trading period of three hours up from the previous two hours. Trading now starts at 10:00 am and ends at 1:00 pm, as opposed to the previous period of 10:00 am to noon.

Automation trading started on the low though, clocking at just Shs 13m mainly of Umeme shares. Nsiko said the low figure, compared to the present average of Shs 200m.

There was concern that figures on the massive screen were not updating as fast as trading, Andrew Mwine, a USE official, said everything went according to plan. He said they are particularly happy that brokers were able to place bids and offers successfully.