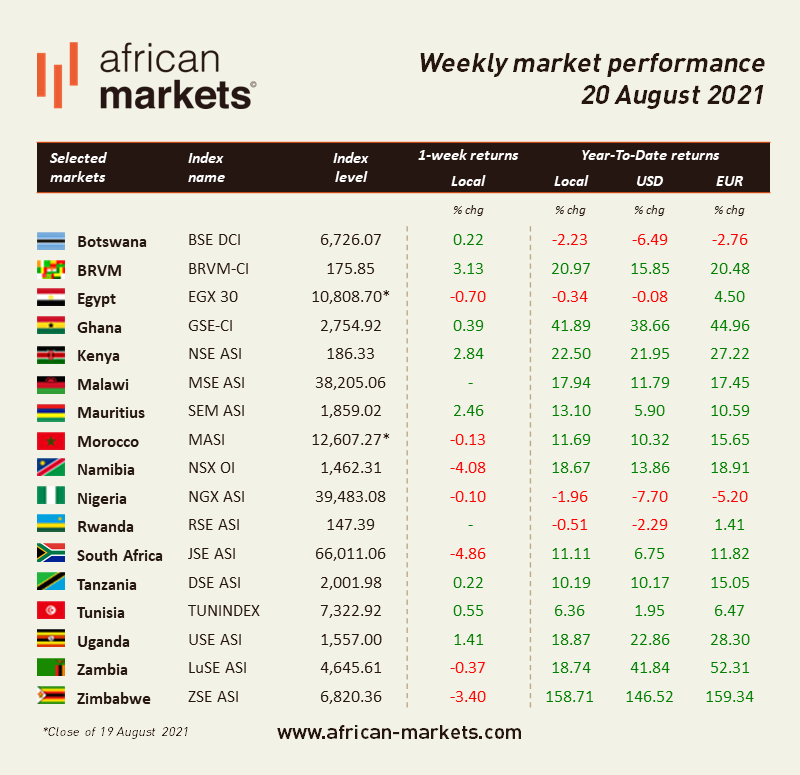

The sentiment was mixed on African equity markets this week. Among the 17 markets we cover, nine advanced while six retreated mildly and two remained flat. The BRVM led the pack as equities in Abidjan gained 3.13%. Conversely, the Johannesburg Stock Exchange was the laggard. South African equities dropped 4.86% this week, the most on the continent.

West Africa

BRVM - Bulls set the tone in Abidjan this week, helping equities advance for the seventh week in a row. Overall, the Composite Index jumped 3.13% WoW to close at 175.85. Market activity soared 65% as XOF 407m (USD 0.72m) worth of shares changed hands every day on average compared to XOF 247m the week before. The market is now up 20.97% year-to-date, and the total market capitalisation amounts to XOF 5,292bn (USD 9.44bn). Societe de Limonaderie et Brasseries d'Afrique SA (SOLIBRA) is once again one of the top performers this week. Shares in the beverage company jumped another 33.49% and are up 197.01% YTD. The market heavyweight, Sonatel, remained flat at XOF 14,000 on Friday. It is up 3.70% since the start of the year.

NGX - Equities in Lagos cooled down this week. The NGX ASI, the benchmark index of the Nigerian exchange, shed 0.10% WoW, closing on Friday at 39,483.08. Stocks are now down 1.96% YTD. Activity declined 16% as NGN 2.1bn (USD 5.15m) worth of shares were traded daily on average over the week. The total market capitalisation stands at NGN 20.6tn (USD 50.0bn). Honeywell Flour Mills is the top performer. Shares in the food producer jumped 46.34% and are now up 150% YTD. The market heavyweight, Dangote Cement, closed higher at NGN 249.6 on Friday (up 3.31% WoW).

North Africa

BVC - Moroccan equities cooled down and halted a four-week streak. The MASI shed 0.13% over the last four days. Market activity declined by 14% as MAD 70m (USD 7.8m) worth of shares changed hands every day on average compared to MAD 82m the week before. The total market capitalisation stands at MAD 648.9bn (USD 72.12bn), up 11.69% YTD. M2M Group is the top performer this week. Shares in the technology company that provides processing solutions, securities management, and other electronic services jumped 16.93% and are now up 11.03% YTD. The heavyweight, Maroc Telecom, closed at MAD 139.05 on Friday (down 0.6% WoW). The stock is down 4.10% YTD.

EGX - Egyptian equities closed lower this week. The EGX 30 gained 0.70% and closed at 10,808.70 points on Thursday. Compared to the previous week, the average daily turnover remained relatively flat at around EGP 1.9bn (USD 122.8m), and the total market capitalisation amounts to EGP 715.2bn (USD 45.6bn). The benchmark index is now up 0.34% YTD. El Shams Housing and Urbanization SAE is the top performer this week. Shares in the real estate developer jumped 51.19% over the period and are now up 135.54% YTD. The Egyptian heavyweight, CIB, closed at EGP 45.39 (+0.65% WoW) on Thursday after the capital increase became effective on August 16th. Shares are now up 2.25% since the start of the year. Fawry, the listed fintech company, closed the week at EGP 16.72 (down 7.37% WoW).

East Africa

NSE - Bullish sentiment prevailed in Nairobi. The NSE ASI gained another 2.84% WoW to close at 186.33. The average daily turnover skyrocketed 86.2% to KES 913m (USD 8.33m), and the total market capitalisation amounts to KES 2,903.8bn (USD 26.49bn). The market is up 22.50% YTD. The Nairobi Securities Exchange is among the best performers this week. The shares in the exchange operator soared 15.60% WoW. The counter is now up 19.85% YTD. Safaricom closed at 44.45 KES (up 3.37% WoW). Shares are up 29.78% so far this year.

Southern Africa

JSE - South African equities dropped heavily as concerns about economic recovery and fresh virus outbreaks weighed on global sentiment. The JSE ASI declined 4.86% WoW to close at 66,011.06, its weakest level in a month. African Equity Empowerment Investments (AEEI) is among the top performers this week. Shares in the diversified majority black-owned investment group jumped 37.50% WoW and are now up 43.09% YTD. The JSE heavyweight, Prosus, closed lower at ZAR 1,226.97 on Friday (-6.29% WoW). Shares in the tech investor are now down 23.61% YTD.

ZSE - Equities cooled down in Harare this week as the ASI declined 3.40% WoW. Daily average turnover jumped 52.7% to around ZWL 289m (USD 3.37m) compared to ZWL 189m the week before. The total market capitalisation amounts to ZWL 811.65bn (USD 9.46bn), up 158.71% so far this year.