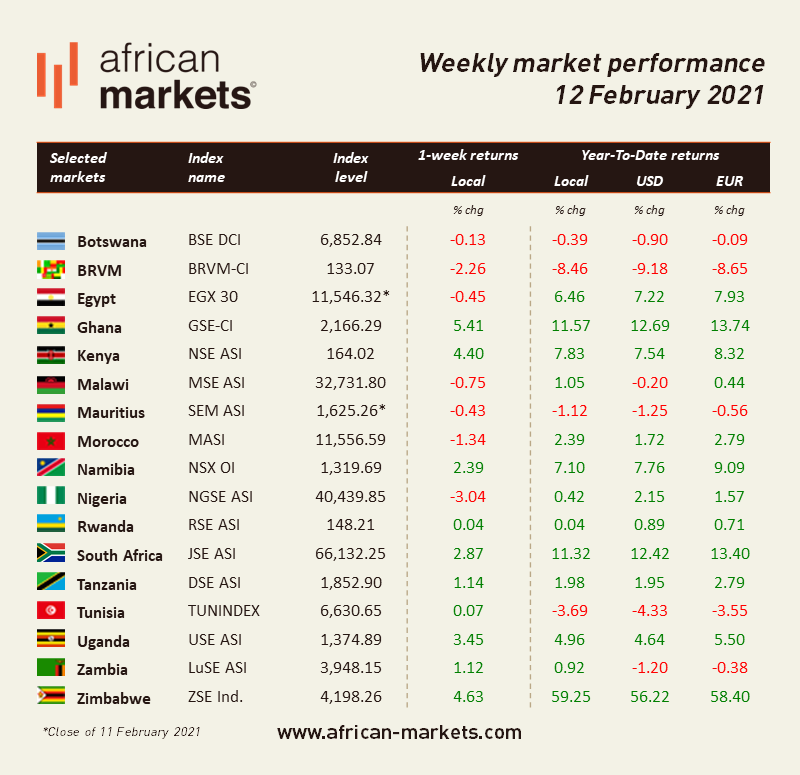

Overall sentiment on African equity markets was mixed. Among the markets we cover, 10 of them advanced this week and 7 retreated. Ghana led the pack as its benchmark index jumped 5.41%. Conversely, Nigeria declined for the second week in a row, shedding another 3.04% over the week.

West Africa

BRVM - Bears were back on the Western Africa regional exchange. The Composite Index lost 2.26% in a thinly traded week that saw only XOF 169m (USD 0.31m) worth of shares change hands every day on average, about a fifth of the daily average turnover of the week before. The market is now down 8.46% year-to-date and the total market capitalization stands at XOF 4,005bn (USD 7.4bn). The top performer this week is the Palmci SA. The stock jumped 8.87% over the 5-day period and is now up 60.89% since the beginning of the year. The market heavyweight, Sonatel, closed the week at XOF 11,200, down 0.8% over the week. Shares in the telecom operator are down 17.04% year-to-date.

NGSE - The bears showed no sign of letting up in Lagos. The ASI closed on Friday at 40,439.85, down 3.04% WoW. Analysts at Greenwich Merchant Bank attributed the bearish performance to “downward price pressures on top counters like DANGCEM and GUARANTY, plus the higher yields offered in the fixed income space, which sent yield-seeking investors away from the market”. A daily average of NGN 4.7bn (USD 12.4m) worth of shares was traded over the last five days. The total market capitalization stands at NGN 21.2tn (USD 55.5bn), up 0.42% year-to-date. The top performer this week is Mutual Benefits Assurance. Shares in the insurer soared 10.53% as the company’s profit after tax jumped 25.9% in 2020. The counter is up 55.56% so far this year. Dangote Cement, on the other hand, lost some ground and closed the week at NGN 220 (-4.35%). The shares in the cement producers are down 10.17% YTD.

North Africa

BVC - Morrocan equities lost some ground this week. The MASI shed 1.34% in a week that saw MAD 107.9m (USD 12.1m) worth of shares changed hands every day on average. Total market capitalization stands at MAD 597bn (USD 66.8bn). Delattre Levivier is the top performer this week. The shares in the engineering and construction company rose 6.35% and are up 39.65% YTD. The heavyweight Maroc Telecom closed at MAD 143.7 on Friday, down 2.11% WoW and 0.90% YTD.

EGX - The Egyptian market edged down this week. The EGX 30 retreated 0.45% and closed at 11,546.32 points on Thursday. Average daily turnover increased marginally to EGP 1.76bn (USD 112.7m) and the total market capitalization amounts to EGP 707.9bn (USD 45.3bn). The benchmark index is up 6.46% so far this year. The top performer this week is Egypt for Poultry. The counter soared 47.14% over the week and is up 97.24% so far this year. The Egyptian heavyweight, CIB, closed EGP 60.86 on Thursday, down 2.82% YTD.

East Africa

NSE - Kenyan equities had an impressive week. The Nairobi Securities Exchange’s benchmark index soared 4.4% WoW. Average daily turnover stood at KES 455m (USD 4.2m) and the total market capitalization amounts to KES 2,520bn (USD 23bn). The market is up 7.83% year-to-date. The top performer this week is Sasini Plc. The stocks of one of Kenya’s main tea and coffee producers jumped 10.91%, recouping some previous losses. The counter is down 7.18% so far this year. Safaricom reached new heights. Shares in the telecom operator closed at KES 37.80 on Friday, up 10.36% this year.

Southern Africa

JSE - Bullish sentiment prevailed in South Africa. The JSE ASI jumped another 2.87% to cross the 66,000-mark and closed at 66,132.25. The benchmark index closed at a record high, tracking firmer global markets as progress on stimulus, vaccines and positive global economic data lifted sentiment. South African equities are up 11.32% so far this year. The top performer on the mainboard this week is ArcelorMittal South Africa. The shares in the South African steelmaker soared 75%. The company benefited from a global shortage of steel due to a sharper than expected recovery in nearly all markets that pushed international steel prices back to their highest since 2008. This helped the company narrow its losses.

ZSE - The Zimbabwean market had a relatively calmer week as the ASI jumped 4.63%. Daily average turnover declined to ZWL 86m (USD 1.03m) and total market capitalization reached ZWL 504bn (USD 6.1bn). The logistics group Unifreight Africa Limited remains the continent’s top performer this week. The company’s stocks gained 133.26% WoW and have been multiplied by 14 since the start of the week.