Global Credit Ratings has affirmed the national scale ratings assigned to Equity Group Holdings Plc (formerly Equity Group Holdings Limited) of AA-(KE) and A1+(KE) in the long term and short term respectively; with the outlook accorded as Stable. The ratings are valid until September 2018.

SUMMARY RATING RATIONALE

Global Credit Ratings (“GCR”) has accorded the above credit ratings to Equity Group Holdings Plc (“EGH”, “the group”) based on the following key criteria:

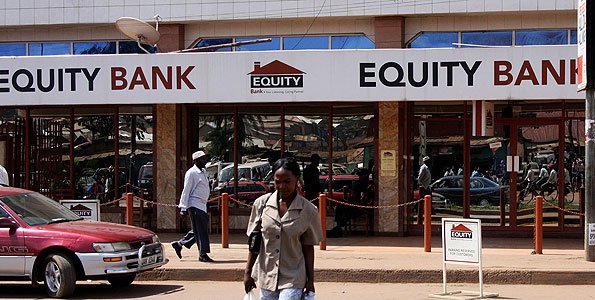

The accorded ratings assigned to EGH reflect its strong competitive position in Kenya’s banking industry, which is underpinned by a favourable market reputation, as well as a resilient and innovative financial services business, spread across East Africa and the Democratic Republic of Congo.

EGH is a non-operating holding company. Equity Bank (Kenya) Limited, a wholly-owned subsidiary of EGH and the group’s main operating entity, accounted for 80.2% of group assets at FY16. The group’s banking and non-banking subsidiaries are held directly by EGH.

Profitability remained resilient in FY16 despite challenging operating conditions, characterised by economic and political uncertainty and unfavourable banking developments in Kenya. EGH posted an after-tax profit of KES16.6bn (FY15: KES17.3bn), despite a sharp rise in impairments. The group achieved a ROaE and ROaA of 21.7% and 3.7% in FY16 respectively, driven by efficiency gains from digitalisation and higher margins.

Robust internal capital generation (FY16: 20.4%) supported the group’s capital base, which remains strong for the current level of risk. At FY16, the total risk-weighted capital adequacy ratio for the group was 18.9% (FY15: 19.7%).

The capping of interest rates and rising asset quality pressure in Kenya’s banking market saw a slowdown in credit growth. The bank’s net loan growth was negative in FY16 following successive years of high loan book expansion. Gross non-performing loans rose to 6.8% of gross loans at FY16 (FY15: 3.4%). Despite increased asset quality risk, which has been exacerbated by the group’s focus on lending to small-and-medium sized enterprises, GCR expects EGH to maintain its track record of strong profitability and capitalisation, in turn, providing adequate protection against downside risks.

The group’s ratings could be positively impacted by an enhancement of its market share, increased earnings diversification and higher support assumptions, while maintaining sound financial fundamentals. Downward pressure on the ratings could arise from sustained pressure on profitability stemming from a further significant increase in loan loss provisions, inadequately controlled growth and a higher susceptibility to regulatory, political and economic changes across operating jurisdictions, or from a marked decline in liquidity or capitalisation.

NATIONAL SCALE RATINGS HISTORY

Initial rating (July 2005)

Long term: A(KE); Short term: A1-(KE)

Outlook: Stable

Last rating (August 2016)

Long term: AA-(KE); Short term: A1+(KE)

Outlook: Stable