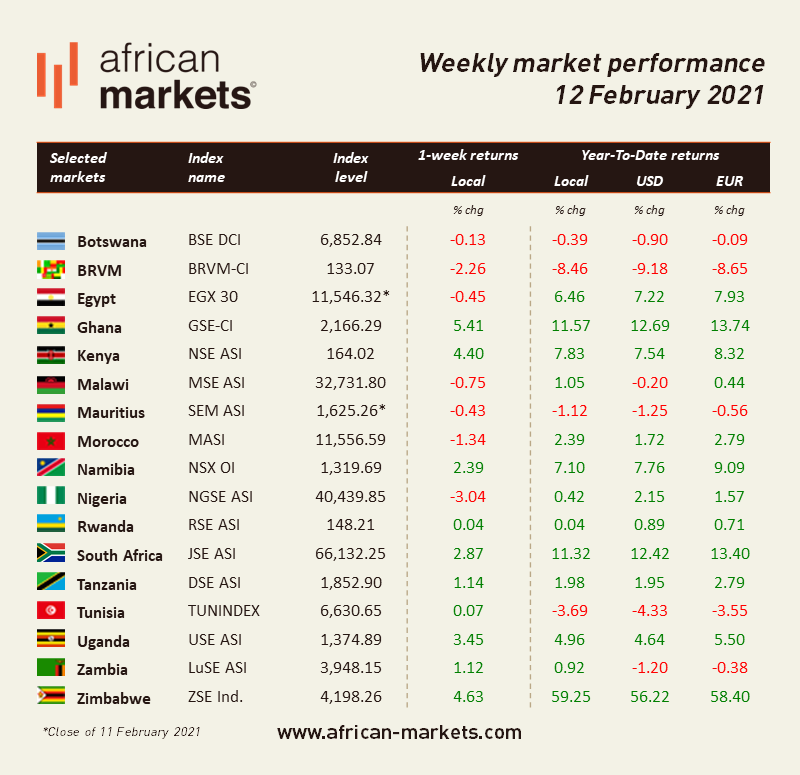

Le sentiment général sur les marchés boursiers africains était mitigé cette semaine. Parmi les marchés que nous couvrons, 10 d'entre eux ont terminé la semaine en hausse et 7 ont reculé. Le Ghana a mené le peloton alors que son indice de référence a bondi de 5,41%. À l'inverse, le Nigéria a reculé pour la deuxième semaine consécutive, perdant encore 3,04% sur la semaine.